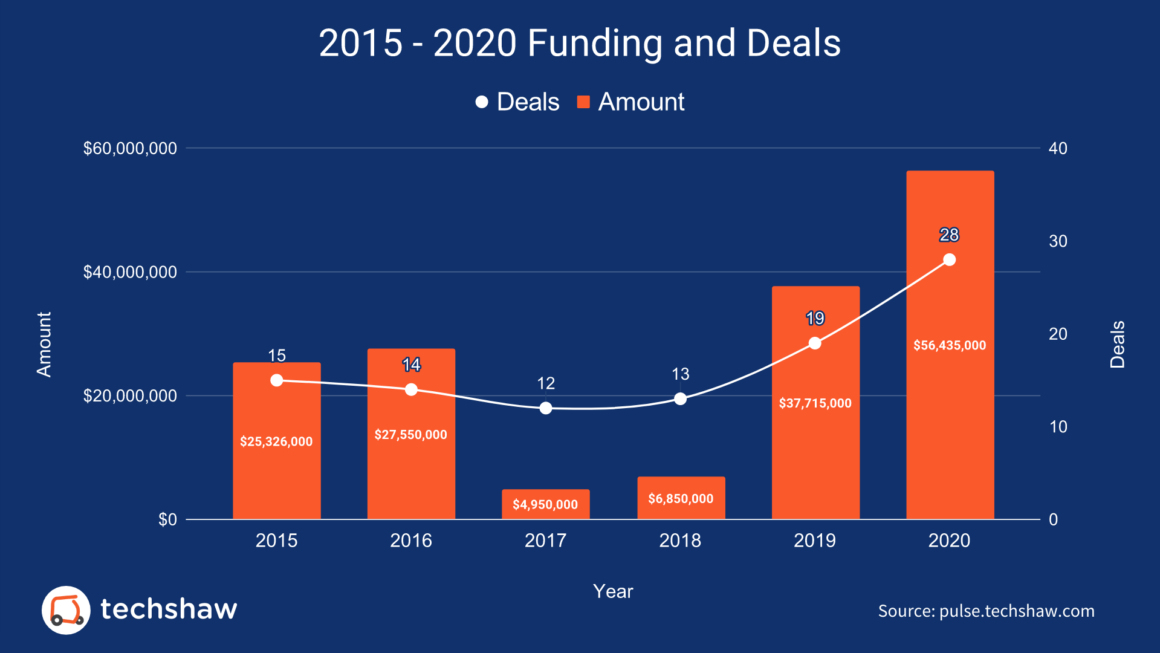

In 2020, Pakistani tech startups raised a record $56 million across 28 deals. Compared to 2019, the amount of funding increased 50% whereas deals were up 47%.

Highlights

💰 $56,435,000 — Total amount raised by 27 startups.

#️⃣ 28 — Number of deals during the year.

📊 50% — Year over year growth in funding.

📈 $2,015,536 — Average deal.

🛒 E-Commerce — Most funded category.

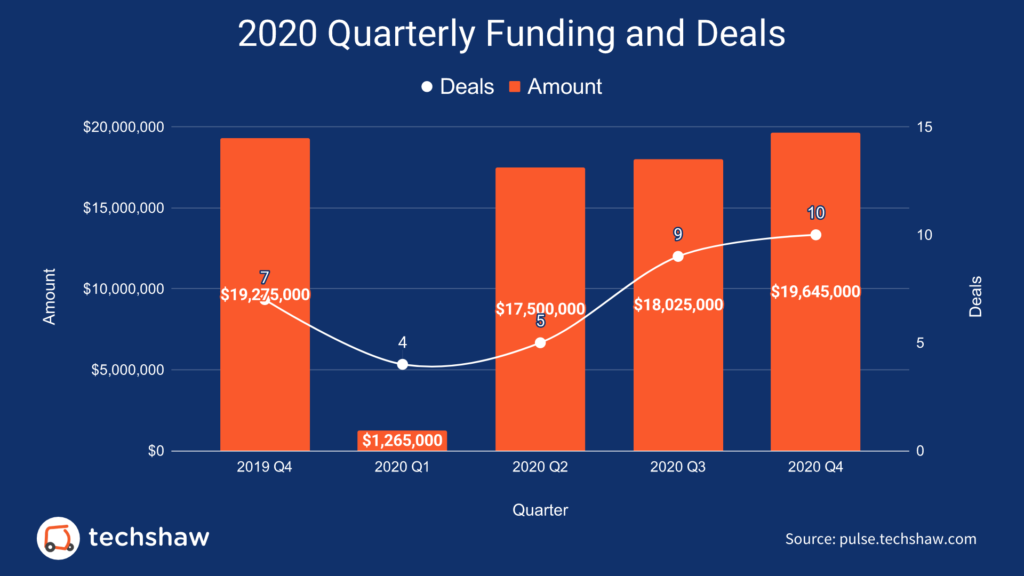

2020 Q4 Funding

The year started strong with 4 startups raising $1.2 million to end Q1 with positive momentum. That was followed by an even better Q2 as 5 startups raised $17.5 million. Q3 didn’t disappoint either as 9 startups raised $18 million.

There were no signs of a slowdown in Q4. Ten startups raised $19,645,000 in disclosed funding. Compared to Q4 2019, it increased 2% from $19,275,000 and 9% increase over the previous quarter.

Another Year, Another Record

Until 2020 happened, the best year on record for Pakistani startups was 2019. Eighteen startups raised $37 million across 19 deals.

When the COVID-19 pandemic began, many rightly speculated there would be a slowdown in funding. But while investors and startups were cautious, every quarter was better than the previous one.

Let’s do the numbers.

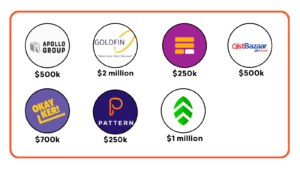

List of Pakistani tech startups that raised Pre-Seed, Seed, Pre-Series A, Series A, Series B and Convertible Note funding in 2020:

- Screen-IT, a Lahore-based Ad-tech startup, raised $250,000 in Seed funding from Coeus Solutions.

- InstaCare, a Lahore-based health tech startup, raised $140,000 in Seed funding from Khaleef Technologies.

- MandiExpress, a Karachi-based grocery delivery startup, raised $725,000 in Seed funding from Lakson Investments Venture Capital.

- Tajir, a Lahore-based B2B e-commerce marketplace startup, raised two rounds of funding this year. First, it raised $150,000 in Seed funding from Y Combinator. And later, it raised $1,800,000 in seed funding from Fatima Gobi Ventures, Pioneer Fund, GoldenGate Ventures, VentureSouq, Karavan, and several angel investors.

- Bazaar, a Karachi-based B2B e-commerce marketplace startup, raised $1,300,000 in Pre-Seed funding from Indus Valley Capital and Alter Global.

- Airlift, the app-based vanpool service provider, raised $10,000,000 in Series A from Quiet Capital, TrueSight Ventures, RT Ventures, Shorooq Partners, ACE Capital, and existing investors.

- Emeds.pk, the Lahore-based prescription delivery startup, raised $250,000 in Seed investment from VM Interactive.

- Social Champ, the Karachi-based social media management app, raised $225,000 in Seed investment from a private angel investor.

- GrocerApp, the Lahore-based grocery delivery startup, raised $1,000,000 in Seed investment from Jabbar Internet Group, Karavan, Nama Ventures, Nader Group, 7Vals, Walled City Co, LeanBricks, Sheharyar Ali, and Asif Keshodia.

- Baby Planet, the Lahore-based e-commerce startup in the baby products niche, raised $250,000 in Seed investment from High Output Ventures, Karavan, and Virtual Force.

- Safepay, the Karachi-based FinTech startup in the payment processing niche, raised $150,000 in Seed investment from Y Combinator.

- Byte, the Lahore-based cloud kitchen delivery startup, raised $150,000 in Seed investment from Y Combinator.

- Aimfit, the Lahore-based health tech startup in the fitness niche, raised $1,000,000 in Seed investment from Indus Valley Capital and other undisclosed Angels.

- Bykea, the Karachi-based transportation and logistics startup, raised $13,000,000 in Series B investment from Prosus Ventures, Sarmayacar, and Middle East Venture Partners.

- Healthwire, the Lahore-based health tech marketplace, raised $700,000 in Series A investment from 47 Ventures.

- MedznMore, the Karachi-based online pharmacy startup, raised $2,600,000 in Seed investment from undisclosed investors.

- FindMyAdventure, the Karachi-based travel marketplace startup, raised $600,000 in Pre-Series A investment from undisclosed investors.

- Bagallery, the Karachi-based e-commerce startup in the fashion space, raised $900,000 in Pre-Series A investment from Lakson Investments Venture Capital.

- Conatural, the Lahore-based e-commerce startup in the beauty space, raised $825,000 in Pre-Series A investment from Karavan and multiple angel investors.

- Clicky, the Rawalpindi-based e-commerce startup, raised $700,000 in Pre-Series A investment from Asif Keshodia and other Angel investors.

- Roomy, the Islamabad-based hospitality startup, raised $1,000,000 in Pre-Series A funding from Lakson Investments Venture Capital.

- Finja, the Lahore-based FinTech startup, raised $9,000,000 in Series A funding from ICU Ventures, BeeNext, Vostok Emerging Finance, Quona Capital, and Gray MacKenzie Engineering Services.

- Tapmad, a Karachi-based live and on-demand video streaming startup, raised $4,000,000 in Series A funding from MBC Group.

- Ricult, a Lahore based (HQ in US) Agri-tech startup, raised $2,000,000 in Seed funding from Bualuang Ventures.

- Integry, a Lahore based (HQ in US) SaaS startup, raised $1,000,000 in Seed funding from multiple Angels.

- RetailO, a Karachi based (HQ in Saudi Arabia) B2B e-commerce marketplace startup, raised $2,300,000 in Pre-Seed funding from Shorooq Partners, 500 Startups and 92 Ventures.

- Bookme.pk, a Lahore based e-ticketing platform, raised $400,000 in convertible debt from Lakson Investments Venture Capital.

This list includes VC or Angel funded active startups founded or co-founded by a Pakistani and headquartered in Pakistan and or having majority of operations or employees or founders/co-founders in Pakistan.

Observations

All things considered, 2020 was a fantastic year for Pakistani tech startups. Earlier during the year, I reached out to few active investors. The responses I received indicated they were cautiously optimistic given the new realities on the ground.

I don’t think anyone could have predicted what happened next. It was a year of many surprises.

- Largest Pre-Seed and Seed funding rounds — Bazaar and MedznMore.

- Pre-Series A became mainstream.

- First Series B funding round since 2015 — Bykea.

- Three startups graduated from Y Combinator — Tajir, Safepay and Byte.

- Two travel related startups raised funding during the pandemic — FindMyAdventure and Roomy.

2021 Outlook

Pakistani startups are not doing anything that can be described as innovative. Some startups are adding Pakistani flavor to proven ideas in other countries and others are simply helping legacy businesses embrace digital.

2020 was a wake up call for legacy businesses to re-imagine their future, which in turn accelerated adoption of new tech. This will continue to happen and even accelerate in the next few years.

There was a time when it wasn’t easy for startups in Pakistan to raise money from local VCs. Sine 2019, that’s not been the case. Now there are VC funds with a cumulative capital of $100 million that are ready and willing to invest. But the tide has turned as there isn’t much deal flow.

If you are a startup, now is the perfect time to dream big and build.