Pakistani startups raised $5.2 million in disclosed equity funding across seven deals in Q2 2023.

That’s 95% less than the $104 million raised in Q2 of 2022 and 78% less than the $23 million raised in Q1 of 2023. Deals decreased by 53% YoY but increased by 17% QoQ.

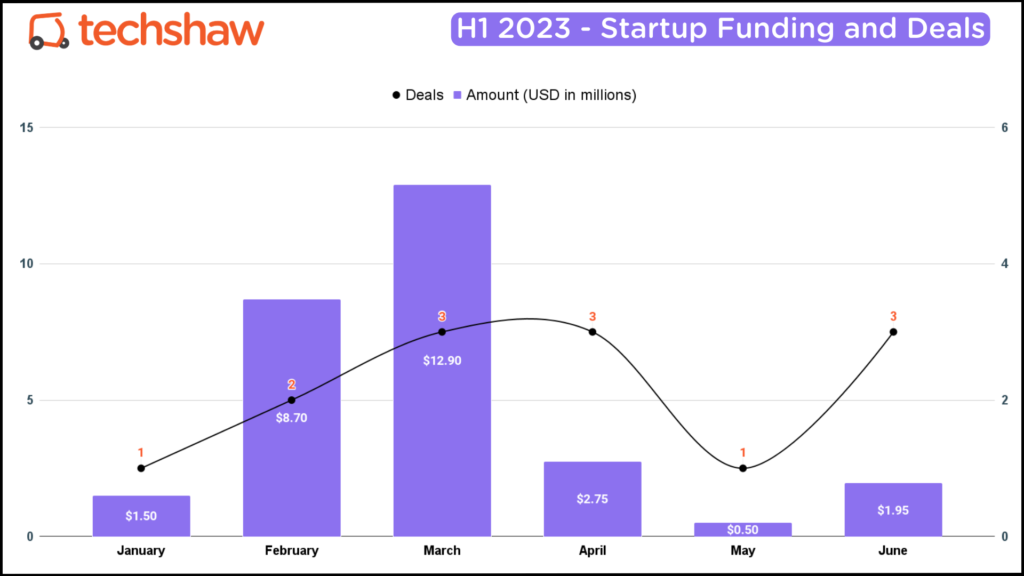

H1 2023 Startup Funding

During the first half of 2023, Pakistani startups raised $28.3 million in equity funding across 13 deals. After a few 2022 hangover deals, the startup funding and deals this year have trended downwards.

At this time last year, Pakistani startups had raised $276 million across 27 deals.

IMF Mubarak

Rather than talk about the dismal state of startup funding this quarter, I’d like to talk about something that I hope will turn the tide in future quarters. You know, the IMF.

Last week Pakistan celebrated Eid-ul-Adha and a $3 billion short-term loan from the IMF. If you live in the 3rd world, IMF is your lender of last resort.

IMF agreed to fund the loan once the Government of Pakistan accepted its austerity measures. It took almost a year for both sides to come to an agreement, leading to unsurmountable pain on the main street.

Pakistan will use the IMF loan to meet short-term needs like debt payments and foreign exchange reserves. But it’s a temporary relief, not a magic wand.

It’s like putting a band-aid over a wound that requires stitches. While the loan may ease some of the immediate pain, it doesn’t address the underlying issues that must be resolved for true healing – and there are so many.

Inflation is 29%, fuel imports are expensive because of subsidies, exports are struggling because of uncompetitiveness, and the Government is engaged in Game of Thrones – making fundamental reforms difficult.

So how does all this bad news help turn the tide for startup funding?

Startup investors, both foreign and local, crave stability. When founders pitch, investors aren’t just looking at the business but eyeing the country’s economic and political landscape.

This IMF deal could be a nudge in the right direction. It’s like telling investors, “Hey, things might stabilize here.” This could make investors more comfortable and more likely to consider investing. It helps change the narrative and calm default jitters.

I am cautiously optimistic. It will take time to see if the newfound confidence can translate into an actual increase in funding. For now, the IMF deal is a positive development, and here’s hoping it starts to warm things up for startup funding in Pakistan.

Let’s do the numbers.

List of startups that raised funding in Q1 2023

Apollo Group, a Lahore-based HR Tech startup, graduated from YC’s W2023 batch with $500k.

GoldFin, a Lahore-based FinTech startup, raised $2 million in seed funding from Insitor Partners.

EasyFresh, an Islamabad-based AgriTech startup, raised $250k from SOSV’s Orbit accelerator program.

Qist Bazaar, a Karachi-based BNPL startup, raised $500k in equity and $1.2 million in debt funding Bank Alfalah.

OkayKer, a Karachi-based Automotive startup, raised $700k in seed funding from Orbit Startups, Cur8 Capital, FRIM Ventures, and Sabr Capital.

Pattern, a Lahore-based AdTech startup, raised $250k in pre-seed funding from Accelerating Asia.

Neem, a Karachi-based FinTech startup, raised $1 million in seed extension funding from DNI Group.

Endnote

If you think I missed a startup, please DM me on Twitter with the link to the startup funding announcement.

If you want to access the entire database that includes all startup funding transactions since 2014, you can purchase it here.

Criteria: Active VC or Angel-funded startups founded by a Pakistani and headquartered in Pakistan with the majority of employees and at least one founder in Pakistan and a product created for the global and Pakistani market. If not headquartered in Pakistan, the majority of employees and at least one founder is in Pakistan. It does not include rounds with funding amounts less than $250,000.

Data sources: internal tracker.

*Some numbers are rounded up/down for clarity.