In 2023, Pakistan’s startup ecosystem underwent a profound transformation, one of resilience and adaptation.

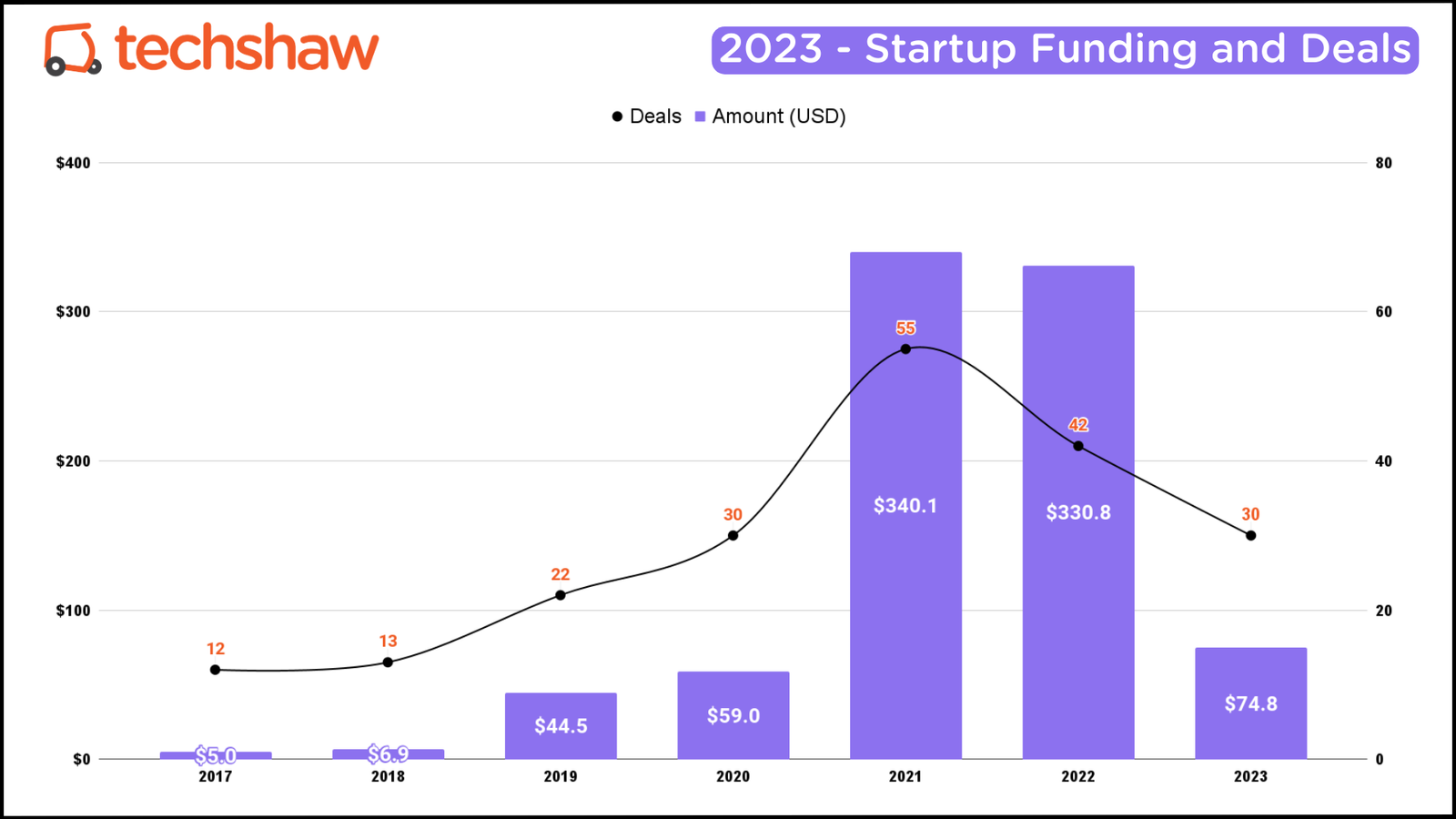

While facing the economic headwinds, entrepreneurs navigated a year of unexpected twists, raising $75 million across 30 deals—starkly contrasting the $331 million in the previous year.

This 77% plunge in funding and 29% decrease in deal volume didn’t just signify a downturn; it began a new chapter where understanding the ebb and flow of economic tides and the nuanced interplay of ground realities became more crucial than ever.

The jolt of reality

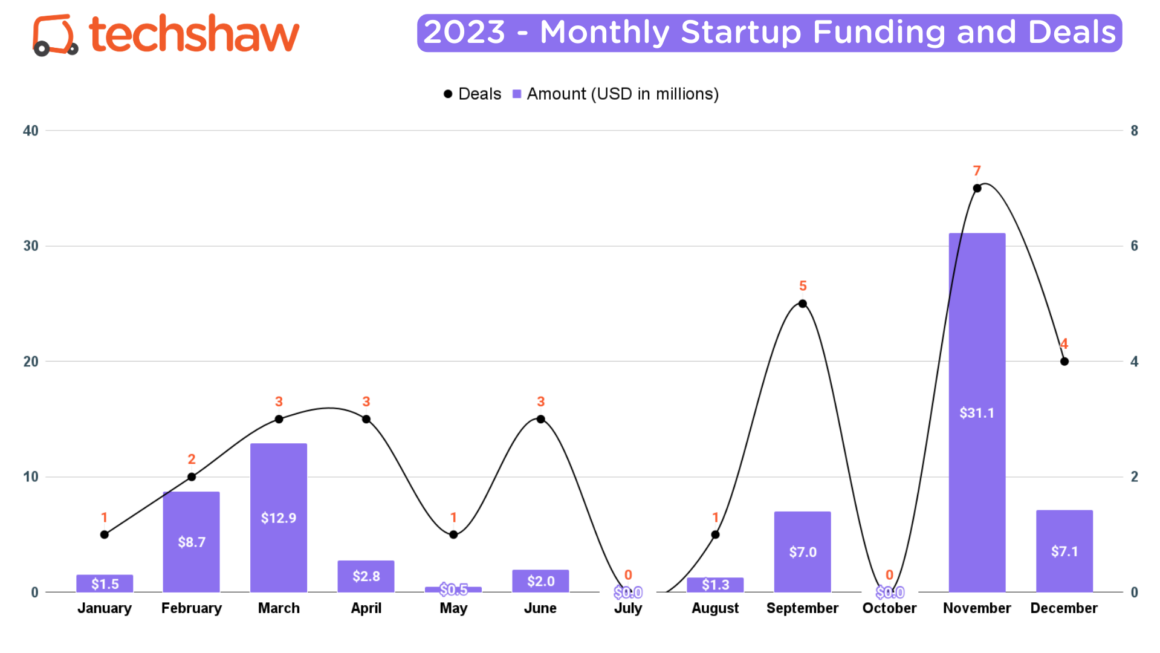

It was a hard landing for the Pakistani startup ecosystem in the first quarter after dizzying heights of optimism.

Fundraising plummeted by a staggering 85% YoY, with a modest $23.1 million across six deals.

Why? Blame it on global economic shifts and the end of the easy-money era as Uncle Sam turned off the ZIRP tap.

Once eager to pour funds into Pakistan’s frontier market, investors turned cautious, recalibrating in response to the increase in the fed funds rate.

240 million people. Youth bulge. English speakers – all vanity metrics.

The struggle

As the second quarter unfolded, startups raised $5.2 million across seven deals, a jaw-dropping 95% decrease YoY. It wasn’t just about the numbers dwindling; it was about the harsh reality of economic constraints setting in.

Amidst this uncertainty, the International Monetary Fund (IMF) approved a bailout for Pakistan for the 23rd time in its 75-year history.

The $3 billion loan, akin to a band-aid on a deep wound, was a temporary salve. Yet it promised gradual healing and steering the economy towards a semblance of stability.

The struggle continues

The third quarter got ugly as two notable startups, MedznMore and Jugnu, shut down abruptly, shaking the ecosystem.

Following Airlift’s high-profile failure in 2022, these shutdowns highlighted the volatility and challenges inherent in the startup ecosystem.

Despite these setbacks, the quarter still managed $8.3 million across six deals, an 85% drop YoY but a significant achievement given the circumstances.

Glimmer of hope

As the year progressed, the fourth quarter offered a glimmer of hope.

The annual tech event +92Disrupt became a catalyst for funding, with deals worth $38 million announced, marking a 152% growth in funding YoY.

For startups raising funding, this was a much-needed reprieve and a sign of potential stability for a country grappling with inflation, fuel crises, and political turbulence.

This turnaround, contrasting the earlier quarters, indicated a possible shift in the ecosystem’s trajectory.

Let’s wrap it up

The first quarter started somberly, with a significant funding decline. The second and third quarters continued this trend, with the shadow of economic challenges looming large. However, the fourth quarter emerged as a beacon of hope.

Until November, it didn’t look like the total funding would reach $50 million. But fortunately, things turned a corner. Sure, $75 million is nowhere close to the $331 million raised in 2022, but then again, 2021 and 2022 represented an abnormal amount of funding because of ZIRP.

I am surprised more startups didn’t fail. Although blockbuster funding may not have marked the year, it was a story of adaptation, weathering storms, and finding hope in challenging times.

Make it make sense

As the curtain falls, let’s step back and view this narrative through a broader, more hopeful lens.

The startup funding trend in Pakistan mirrors the phases of the Gartner Hype Cycle, a conceptual framework that maps the life cycle of technological innovations.

Looking at the funding within this framework offers an understanding of what lies ahead.

The year 2023, with its significant funding drop and the closure of two high-profile startups, resembles the ‘Trough of Disillusionment’ phase of the Gartner Hype Cycle.

This stage is often characterized by skepticism and a recalibration of expectations following an initial surge of excitement. It’s a period where the initial gloss of the ‘Peak of Inflated Expectations’ has faded, and the stark realities of market dynamics and economic factors set in.

However, this phase is not just an end; it’s a transformative period that paves the way for the ‘Slope of Enlightenment.’

The lessons learned from the trough’s challenges in this next phase lead to more sustainable and practical approaches.

Startups begin to adapt, finding more realistic and market-aligned ways to grow. Innovators and entrepreneurs, seasoned by their experiences, start building more robust, resilient businesses.

The focus shifts from rapid, often unsustainable growth to steadier, more strategic development.

For the startup ecosystem in Pakistan, the IMF loan, alongside the modest recovery observed in the fourth quarter, signifies the onset of a new phase. This ecosystem is in a state of continuous learning, adapting, and evolving.

As we look toward the future, it’s important to remember that the Gartner Hype Cycle is a cycle of renewal and growth. The current challenges are not permanent setbacks but stepping stones toward a more mature and stable startup ecosystem.

Seriously, let’s wrap it up.

2023 humbled the startup ecosystem in Pakistan, instilling a newfound appreciation for the delicate balance between ambition and market realities.

The Gartner Hype Cycle offers a lens of optimism, reminding us that every downturn is an opportunity for renewal and that every challenge is a stepping stone to success.

Predicting the future is impossible, but I will do it anyway.

The startup ecosystem in Pakistan will reach the ‘Plateau of Productivity’ in the next five years, with sustainable and scalable businesses becoming the norm. Cautious optimism is the name of the game. Today’s ecosystem will look quaint a few years from now and take a life of its own.

It will be bumpy in the meantime. Forward is the only way.