In March 2019, Uber acquired Careem for $3.1 billion. Having previously raised $1 billion in funding and valued at $2 billion, a clear win for Careem — the product, the employees, and the investors.

However, there’s a cloud of uncertainty around the deal according to Uber’s financials.

Uber’s 10-Q discusses the Careem acquisition with a cautionary tone, almost as if the deal will not go through.

It’s common practice to use cautionary verbiage in financial reports.

It’s ‘covering-ass-if-shit-hits-the-fan’ approach.

Let’s unpack.

1) The Deal

“On March 26, 2019, the Company entered into an asset purchase agreement (the “Agreement”) with Careem Inc. (“Careem”). Pursuant to the Agreement, upon the terms and subject to the conditions thereof, Augusta Acquisition B.V., an indirect wholly-owned subsidiary of the Company, will acquire substantially all of the assets and assume substantially all of the liabilities of Careem for consideration of approximately $3.1 billion, subject to certain adjustments. The total consideration will consist of up to approximately $1.7 billion in non-interest-bearing unsecured convertible notes and approximately $1.4 billion in cash.”

— 10-Q

Reverse Triangular Merger

Technically a merger is the most common type of acquisition deal.

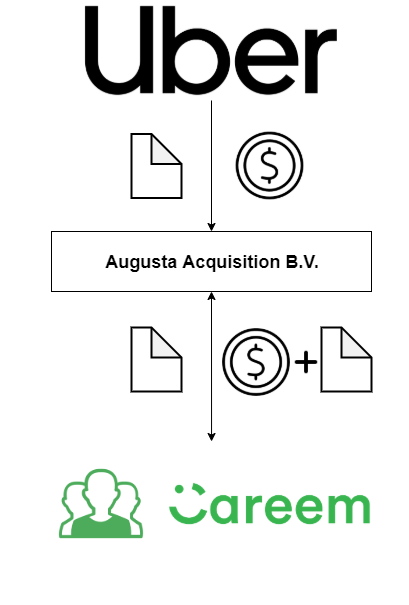

Uber —(Stock and Cash)→ Augusta Acquisition B.V.

Careem — (Assets and Liabilities)→ Augusta Acquisition B.V.

Augusta Acquisition B.V. — (Uber Stock and Cash)→ Careem shareholders

Careem shareholders — (Stock)→ Augusta Acquisition B.V.

Augusta Acquisition B.V. → Careem (merger)

Confused?

Let me try again.

For the purpose of this acquisition, Uber created a subsidiary Augusta Acquisition B.V.

This entity assumed all of Careem’s assets and liabilities and in return, Careem’s shareholders received Uber stock and cash.

Augusta Acquisition B.V. will then merge into Careem, leaving Careem as the surviving entity (not shown in the diagram above).

Yes, it’s a tax shenanigan. Let’s move on.

$3.1 billion; $1.7 in convertible notes and $1.4 billion in cash.

A convertible note is a financial instrument that converts into stock at a given point in time.

In this case, the convertible note will be issued to Careem shareholders in January 2020 when the deal closes and will mature 90 days after issuance.

During the 90 days, Careem shareholders can convert the note to Uber’s common stock at $55/share.

If they opt not to convert, Uber will pay cash.

2) The Issues

“We will acquire substantially all of the assets and assume substantially all of the liabilities of Careem, including liabilities associated with any data security breaches it has experienced in the past. Our acquisition of Careem is subject to a number of risks and uncertainties, including, in particular, that we must obtain the approval of competition authorities in certain markets in which Careem operates, and we cannot guarantee that we will be able to obtain approval in any or all of these markets. The acquisition could be blocked, delayed, or subject to significant limitations or restrictions on our ability to operate in one or more markets, and we could be required to divest our or Careem’s business in one or more markets.”

— 10-Q

Data Breach and Information Sharing

In April 2018, Careem disclosed a data breach that happened in January 2018. Careem users who had signed up before January 14, 2018, had their names, email addresses, phone numbers, and trip data hacked.

Passwords and credit card information weren’t breached during this hack.

In the countries where Careem operates, it’s common for the Government to require that it share data related to customers and drivers. This, however, is in conflict with Uber’s data-sharing policies.

Careem will have to transition to Uber’s more stringent data-sharing policies after the acquisition. This may irk certain Governments leading them to take adverse actions.

Monopoly

Careem has operations in U.A.E (HQ), Egypt, Jordan, Qatar, Saudi Arabia, Bahrain, Lebanon, Kuwait, Morocco, Turkey, Oman, Palestine, Iraq, Algeria, and Pakistan.

In the majority of these countries, Careem competed with Uber before the acquisition. After the acquisition, there will essentially be just one player creating a monopoly.

U.A.E and Jordan authorities have blessed the deal.

In Egypt, Pakistan, and Saudi Arabia, antitrust agencies are reviewing the deal.

Qatar, which represents 1.8% of Careem’s overall business, has rejected the deal.

3) No Deal

“Although Careem has agreed to a reduction of the purchase price in the event we do not receive regulatory approval in some or all of the markets in which Careem operates, any such reduction would be limited to only a portion of the value ascribed to Careem’s operations in such markets, and any such reductions in the aggregate would be capped at 15% of the total purchase price. Additionally, 10% of the total purchase price will be subject to a holdback for a limited period of time after the closing of the acquisition to satisfy any potential indemnification claims. Accordingly, we will be required to pay at least 75% of the total purchase price (including the full cash portion of the purchase price) upon the closing of the acquisition, regardless of which, if any, competition approvals we are able to obtain prior to the closing date.”

— 10-Q

$2.8 billion vs. $3.1 billion

You have it to hand it to Careem lawyers here. They negotiated that even if the deal doesn’t go through in problematic jurisdictions, Careem would still get all the cash plus 85% ($1.4 billion) of convertible notes.

In September, strapped for cash, Uber issued a $1.2 billion junk bond and raised $750 million. According to Uber, they had to do this to finance part of the Careem acquisition.

Uber-esque Behaviour

Careem recently sent an email to former employees asking them to forfeit 25% of the value of vested RSUs. In fact, it defaulted them into accepting this change. The other option is, get 75% of the value after the closing of the acquisition in January and 25% over 30 months.

This is classic Uber behavior.

Uber has a tainted past with respect to equity compensation. Employees have revolted and there was also a lawsuit.

Careem, to sweeten the deal and make it easier for Uber, engaged in a little financial engineering of its own. Spreading the payments over 30 months will tremendously help Uber.

Parting Thoughts

Uber announced Careem acquisition in March, dropped S-1 in April, and IPO’ed in May. Given the lackluster IPO and the current stock price, it’s fair to say, the optics didn’t work.

However, this was an excellent win for Pakistan, Careem’s largest market.

Well, almost.

Overnight, the country with 220 million people where Careem built its engineering muscle and culturally appropriate marketing prowess, went from uncertain to a validated market.

But wait…

I once heard Mudassir Sheikha, Co-founder and CEO of Careem, say, “Dubai is the best place to live in Pakistan.”

I am Pakistan-born, Dubai bred. I wholeheartedly agree with him.

I digress.

All the value creation happened in Dubai, all the value extraction happened in Pakistan.

I don’t say this to take a dig at Careem. I say this to highlight what Pakistan missed — a homemade Unicorn.

“Additionally, although we have entered into an asset purchase agreement to acquire Careem, we may not ultimately consummate the transaction. Further, because we may not receive local competition authority approval to consummate the transaction in some or all of the markets where such approval is required, we may be required in some or all of such markets to divest all or part of our or Careem’s operations.”

— 10-Q

Let’s hope this transaction “consummates” and Uber and Careem can live happily ever after.