When Airlift raised $85 million in Series B funding – Pakistan’s largest Series B – that was the headline on its blog.

It was a big freaking deal.

Everything that happened at Airlift was BIG or FIRST or TOP.

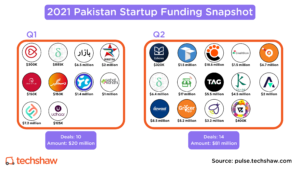

Its $2.2 million seed round in 2019 was the largest seed round at the time. Later, its $12 million Series A was the largest Series A round at the time.

Apart from funding, it built an insanely agile and innovative product team, attracted top talent, and built a company culture that was the envy of the ecosystem.

But then it happened. Something that happens with 90% of the startups.

It failed.

First, it announced layoffs and cutbacks and then closed shop for good.

And yes, Airlift is also the biggest startup failure in Pakistan.

But between raising $150,000 seed for an idea to shut down, a lot happened:

- It created the MVP in three weeks, an app for commuter bus service.

- It went door-to-door to sell its service.

- It maneuvered government resistance and intervention at every stage.

- It turned down acquisition offers.

- It brought First Round Capital to Pakistan.

- It scaled to 50,000 rides per month.

- It took COVID seriously to shut down services temporarily.

- It pivoted to quick commerce and developed a product in six weeks.

- It capitalized on changing consumer behavior and scaled its q-commerce product.

- It raised an insurmountable amount of money on the heels of the pivot’s success.

- It made a difficult decision to lay off people to extend its runway.

- And last but not least, it decided to shut down with two months’ severance pay after it failed to raise follow on funding.

All this, in a matter of 3.5 years.

Sure, it made mistakes. It flew too close to the sun. And it got burned.

It happens.

The Postmortem

The question on everyone’s mind is, so what went wrong? Why did Airlift shut down?

In the press release, Airlift states that it no longer had the money to sustain itself. And while there was a possibility of a bridge round, the investors decided not to proceed.

Does that make sense?

Yes, according to data compiled by CB Insights on why startups fail, 38% of startups fail because they run out of money.

It’s also the number one reason why startups fail.

But the press release states, “Airlift was about three months away from operating profitability (i.e., positive cash flow from operations), and about 6-9 months from company-level profitability (i.e., Free Cash Flow).”

Then why didn’t investors come through? It was so close to breaking even, maybe even becoming profitable.

It’s the economy, stupid

The world has changed since Airlift’s $85 million Series B in Q3 2021.

Everything is in season, from inflation to war to political turmoil.

The US Federal Reserve increased interest rates after printing money like crazy to combat inflation.

As a result, valuation bubbles burst. It started in the public markets, then trickled down to startups.

Liquidity was not a problem as long as the Fed was printing money. No matter what the cost, VCs pushed startups to scale.

As soon as the printing stopped, this became problematic.

VCs advocated free cash flow and frowned upon excess burn. And Airlift was burning cash to scale unprofitable growth like any other startup.

Let’s talk about Pakistan now.

Since April, the country has faced political headwinds and an economy in tatters. These factors, along with the current global economic crisis, contribute to heightened anxiety.

Investors can handle anxiety, but they don’t like uncertainty.

To make a long story short, investors got spooked. For them, the question was whether to keep throwing good money after bad or to retreat.

They decided to retreat.

Am I 100% sure that’s what happened? No. But it’s plausible to me in the absence of first-hand knowledge. And it makes sense, given what’s happening in the world.

It’s the simplest answer.

Hindsight bias

But we are humans and don’t like simple answers, especially when discussing failure. We believe that when something or someone fails, it’s because of malicious intent.

We start looking for patterns when there are none. We begin to fill in the blanks when information isn’t available. And find ourselves trapped in the hindsight bias.

The reaction to Airlift shutting down is a textbook case of hindsight bias.

Now that it has failed, we can look back and say, of course, we knew all along this would happen.

Their burn was crazy, their team was inexperienced, and they didn’t even have product market fit.

Yeah, there’s a real possibility of all of the above. But it’s all subjective.

You are filling in the blanks by relying on anecdotal evidence from an opinion piece containing factually incorrect assertions.

You’re confusing manufactured opinion with journalism.

Suddenly, you think there were financial irregularities because it ran out of money. That’s a leap. You feel profitability projections are dubious because investors are apprehensive—another leap.

But the reality is, you don’t know. And it’s okay not to know.

Parting thoughts

Listen, I get it. You called it in 1997 that Airlift would fail. You win. I love you. *hugs*

I think there’s a lot more at stake here. There is more to the startup ecosystem than Airlift. It’s not the end-all, be-all.

I don’t want unfounded concerns to hijack what Airlift accomplished.

“Between stimulus and response, there is a space. In that space is our power to choose our response. In our response lies our growth and our freedom.”

Viktor Frankl, ‘Man’s Search for Meaning.’

Airlift inspired entrepreneurs to believe good things can happen in Pakistan. And how we respond to its failure will define the ecosystem we are building.

It’s terribly dark in coulda-shoulda-woulda land.

Let’s live for another day, another dawn.