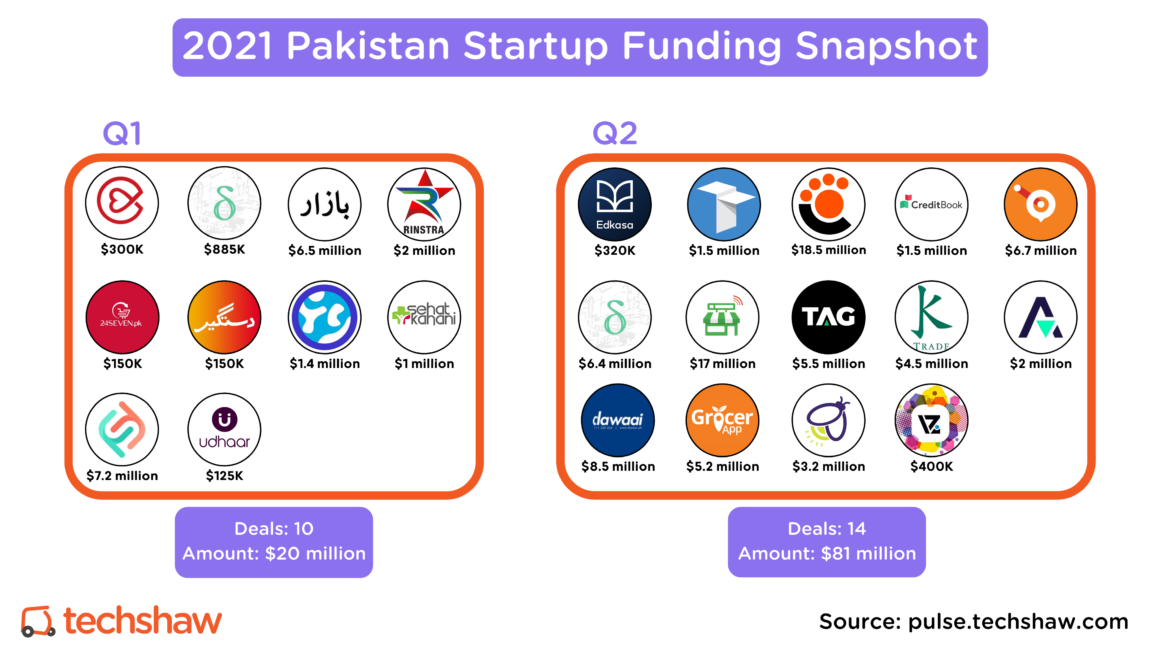

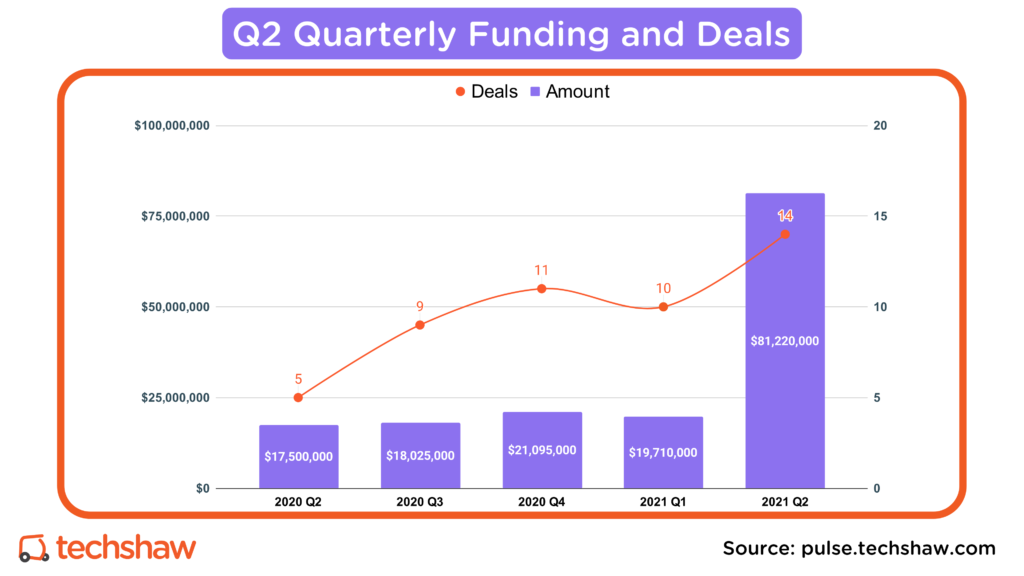

During Q2 2021, Pakistani startups raised $81 million in disclosed funding across fourteen deals.

Compared to the 2nd quarter of 2020, it’s an increase of 364% from $17.5 million. And, compared to the 1st quarter of 2021, it is an increase of 312% from $20 million.

Deals were also up 180% YoY and 40% over the previous quarter.

Q2 2021 Funding

For Pakistani startups, the first quarter of 2021 began on a high note. Ten Pakistani startups raised approximately $20 million in disclosed funding.

But Q2 was a bonanza.

Pakistani startups raised a whopping $81,220,000 in disclosed funding across fourteen deals. And for the first time ever, startup funding surpassed $50 million in any given quarter.

To date, Pakistani startups have raised approximately $101 million in disclosed funding. Again, this is a record in comparison to 2020, when the previous record was set with $59 million.

Let’s do the numbers.

$320,000

Edkasa, the Lahore-based EdTech startup, raised $320,000 in Pre-Seed funding from the i2i Ventures, Walled City Co., Zayn Capital.

$1,500,000

Truck It In, the Karachi-based freight marketplace startup, raised $1.5 million in Pre-Seed funding from Global Founders Capital, Fatima Gobi Ventures, Deosai Ventures, BitRate VC, and +92 Ventures.

$18,500,000

Jabberwock Ventures, the parent company of Cheetay and Swyft, raised $18.5 million from Hummer Winblad Venture Partners, Doris Duke, and Advent International.

The amount raised by Jabberwock is a matter of much debate but it is estimated to be between $16–$20 million. According to Sec Form D, Jabberwock Ventures set out to raise $40 million but was only able to successfully raise $16.7 million. That said, I have learned from a trusted source, the actual amount is close to $18.5 million.

Once an official announcement is made, I will make updates accordingly. Including, if disclosed, how much of the amount raised by Jabberwock will be used towards growing Cheetay and Swyft.

$1,500,000

CreditBook, the Karachi-based lending CRM startup, raised $1.5 million in Seed investment from BitRate VC, Venture Souq, Better Tomorrow Ventures, Ratio Ventures, Toy Ventures, Quiet Capital, and i2i Ventures.

$6,700,000

RetailO, the Karachi-based (HQ in Saudi Arabia) B2B e-commerce marketplace startup, raised $6.7 million Seed funding from Shorooq Partners, Abercross Holdings, AgFunder, and Arzan Venture Capital.

$6,400,000

dTrade, the Karachi-based FinTech startup in the trading space, raised $6.4 million in Seed funding from Three Arrows Capital, DeFiance, Polychain Capital, ParaFi Capital, Huobi, Mechanism Capital, Bixin Ventures, IOSG Ventures, Hypersphere Ventures and Fenbushi Capital.

$17,000,000

Tajir, the Lahore-based B2B e-commerce marketplace startup, raised $17 million in Series A funding from Kleiner Perkins, Y Combinator Continuity Fund, AAVCF, Fatima Gobi Ventures, Flexport, Golden Gate Ventures, Liberty City Ventures, and VentureSouq.

This brings the total amount raised by Tajir to $19 million making it the 3rd most well funded Pakistani startup after Zameen ($29 million) and Airlift ($24 million).

$5,500,000

TAG, the Islamabad-based FinTech startup, raised $5.5 million in Seed funding from Quiet Capital, Liberty City Ventures, Fatima Gobi Ventures, and Unpopular Ventures.

$4,500,000

KTrade, the Karachi-based FinTech startup in the retail stock trading space, raised $4.5 million in Seed funding from from TTB Partners and HOF Capital.

$2,000,000

Abhi, the Karachi-based FinTech startup, raised $2 million in Seed funding from Vostok Emerging Finance, Village Global, Sarmayacar, i2i Ventures, and Zayn Capital.

$8,500,000

Dawaai, the Karachi-based online pharmacy, raised $8.5 million in Series A funding from 500 Startups and Sarmayacar.

With the fresh Series A round, Dawaai has now raised a total of $10.5 million.

One thing to note here is that Planet N, one of the early investors, decided to exit by selling their stake to the new and other existing investors. The return on investment wasn’t publicly disclosed.

$5,200,000

GrocerApp, the Lahore-based grocery startup, raised $5.2 million in Series A funding from Hayaat Global, Millville Opportunities Fund, Wamda Capital, Jabbar Internet Group, Nama Ventures, Haitou Global, Lean Bricks and Walled City Co.

$3,200,000

Jugnu, the Karachi-based B2B Marketplace startup, raised $3.2 million in Series A funding from Systems Limited.

$400,000

Trivzia, the Lahore-based streaming platform, raised $400,000 in Seed funding from 47 Ventures.

Some of the amounts in the description are rounded for simplicity. You can find exact amounts here.

This list includes VC or Angel funded active startups that have publicly disclosed their funding using credible media outlets and:

- founded or co-founded by a Pakistani and headquartered in Pakistan and or having majority of operations or employees or founders/co-founders in Pakistan.

- founded by non-Pakistani but based, operated and or for the Pakistani market.

- founded or co-founded by a Pakistani, having a HQ in different country but the leadership and majority of the team in Pakistan.

Some Thoughts

We seem to hit a new milestone every quarter. This begs the question, are we witnessing a trend or an anomaly?

2020 was an unusual year. Likewise, 2021 will be no different. Based on the past two years alone, yes, it is a trend. However, if we are to take a longer view, it’s an exception.

We will eventually come to a peak, after which the investment landscape will stabilize. Since VCs are flush with cash, this may take time.

One of Silicon Valley’s most prestigious venture capital firms, Kleiner Perkins, made its first investment in a Pakistani startup — Tajir. It was Kleiner Perkins that spearheaded the VC movement in Silicon Valley in the mid 1970s and later went on to fund household names such as Google and Amazon during the dot-com era.

As well as demonstrating startup ecosystem’s strength, the Kleiner Perkins investment also brings international attention to the market opportunity. And with every quarter, stakes keep getting higher and higher.

I know I sound like a broken record but if we can get one big exit, that would be fantastic.

P.S. Thank you Zubair Naeem Paracha for reviewing the list of startups for this post and keeping me honest.