Last month, I published a list of Pakistani startups that raised funding in 2020. Invest2innovate (i2i), Data Darbaar and Magnitt also published funding reports shortly after.

There was a $30 million difference between the highest and the lowest amount reported.

1/13/2021: Magnitt – $77 million

1/11/2021: Data Darbaar – $66 million

1/7/2021: i2i – $66 million*

1/3/2021: Techshaw – $47 million

*i2i initially reported $58 but later revised the amount to $66 million.

Typically, there is a difference between reports. But $30 million is a big difference, so I had to dig in.

Looking closer, I found out that Magnitt includes $11 million as an estimate of undisclosed funding rounds using a “proprietary algorithm.” Needless to say, this is a made up number.

That brings us down to $66 million which is in line with what Data Darbaar and i2i reported. Data Darbaar’s dataset isn’t public but I used i2i’s Deal Flow Tracker to revise my list and identified 5 startups that raised $9.7 million:

- Tapmad, a Karachi-based live and on-demand video streaming startup, raised $4 million in Series A funding from MBC Group.

- Ricult, a Lahore based (HQ in US) Agri-tech startup, raised $2 million in Seed funding from Bualuang Ventures.

- Integry, a Lahore based (HQ in US) SaaS startup, raised $1 million in Seed funding from multiple Angels.

- RetailO, a Karachi based (HQ in Saudi Arabia) B2B e-commerce marketplace startup, raised $2.3 million in Pre-Seed funding from Shorooq Partners, 500 Startups and 92 Ventures.

- Bookme.pk, a Lahore based e-ticketing platform, raised $400K in convertible debt from Lakson Investments Venture Capital.

I was aware of Ricult, Integry, and RetailO funding rounds but left them out as I do not consider startups headquartered outside of Pakistan in my list. However, since all three startups have either a founder or co-founder in Pakistan, have the majority of their employees in Pakistan and run operations from Pakistan, I am revising my list to include them.

Tapmad and Bookme.pk, yes, I missed that. There’s still a $10 million difference between my list and the other 3 reports. However, I cannot see what the differences are as the Data Darbaar and Magnitt dataset isn’t public.

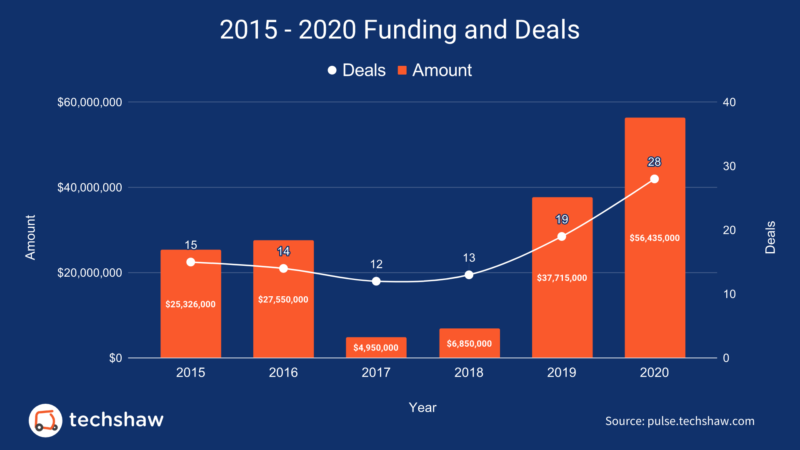

2020 Funding (revised)

💰 $56,435,000 — Total amount raised by 27 startups.

#️⃣ 28— Number of deals during the year.

📊 50% — Year over year growth in funding.

📈 $2,015,536 — Average deal.

🛒 E-Commerce — Most funded category.

You can check out the updated blog post and the corresponding charts here. The list of all funding transactions is available here (Google Sheets).

💰 Funding (disclosed)

$6,500,000

Bazaar, a Karachi-based B2B e-commerce marketplace startup, raised $6.5 million in Seed funding from Indus Valley Capital, Global Founders Capital, S7V, Wavemaker Partners, Derayah Venture Capital, and Next Billion Ventures.

$2,000,000

RINSTRA, an Islamabad based digital media platform, raised $2 million in Series A funding from undisclosed investors.

$300,000

Chkar, a Gilgit-Baltistan based hospitality startup, raised $300,000* in Seed funding from MFSYS.

*converted from Pak Rupees.

💰 Funding (undisclosed)

Safepay raised seed funding from Stripe. Unity Retail raised seed funding from Boston Equity Partners. 24seven.pk raised funding from SOSV. BOGO raised seed funding from Fetchsky and Wah Brands.

📰 Learn

i2c to power Pakistan’s first digital-native financial super app. The EdTech sector in Pakistan has helped sustain education during the pandemic. Pakistan is an increasingly popular destination for BPO outsourcing. The e-commerce market in Pakistan keeps growing at an impressive rate. SECP attempts to modernize business incorporation while the SBP works on making it easier to attract startup investment and improve digital payments. Startups will soon have access to growth funds under ‘PakImpactInvest’ program. Noon Academy and Out-Class both seek to democratize high quality education in Pakistan.

🧠 Read

The need for influencer oversight. Deep-tech is dying in Pakistan. Overly cautious VCs bet on an untapped market. Keeping Urdu alive on your digital devices. Will Daraz lose its position as the e-commerce leader in Pakistan?