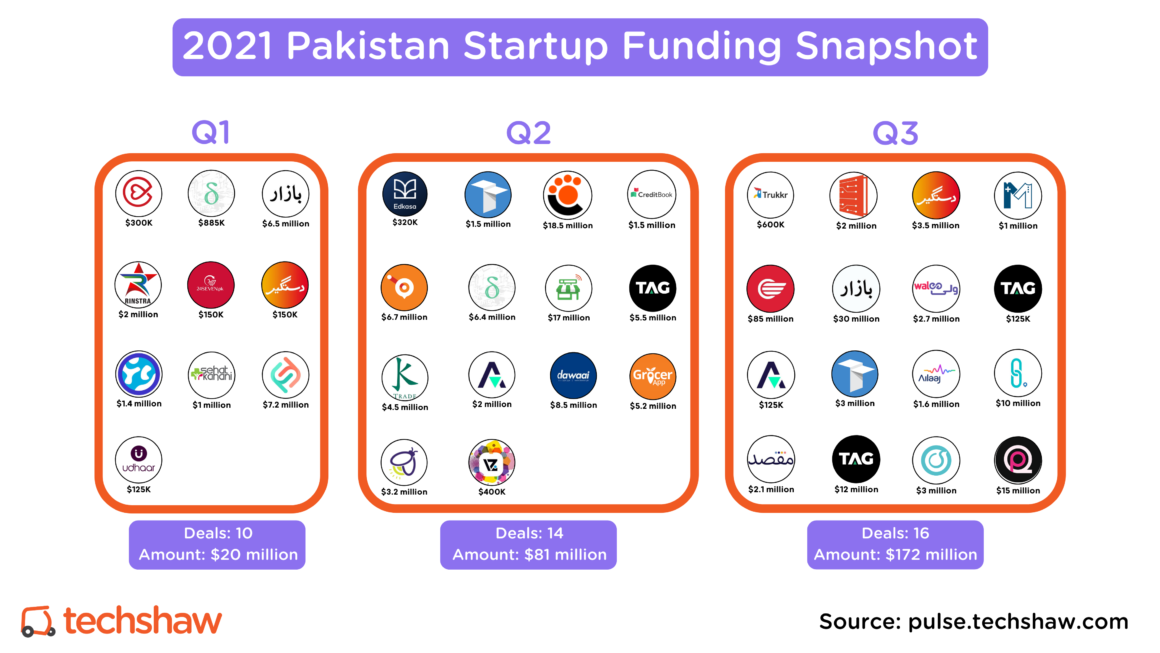

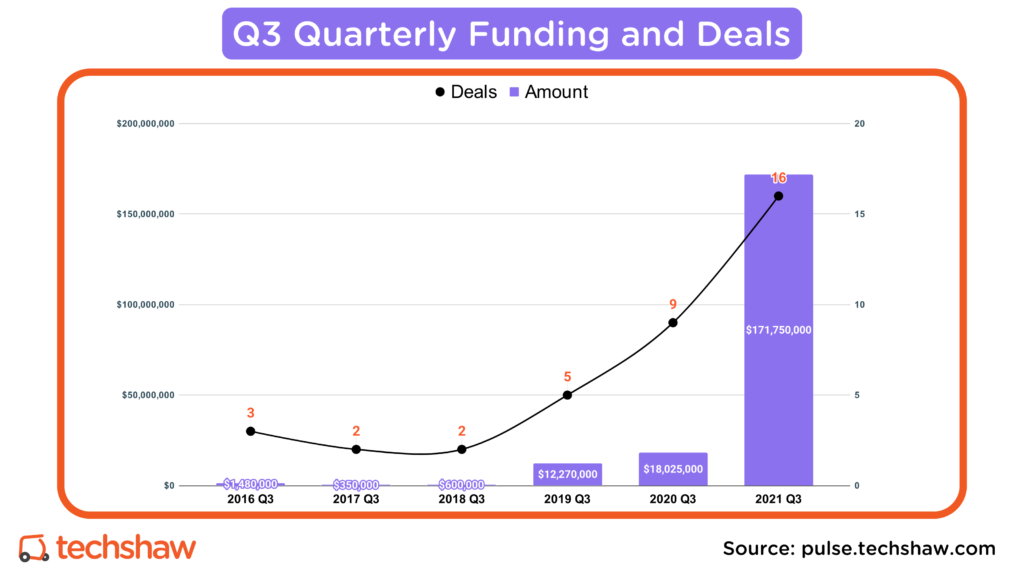

During Q3 2021, Pakistani startups raised $172 million in disclosed funding across sixteen deals.

Compared to the 3rd quarter of 2020, it’s an increase of 853% from $18 million. And, compared to the 2nd quarter of 2021, it is an increase of 111% from $81 million.

Deals were also up 78% YoY and 14% over the previous quarter.

Q3 2021 Pakistani Startup Funding

Pakistani startups started off 2021 on a high note. About $20 million was raised by ten startups in Q1.

The momentum continued in Q2 with Pakistani startups raising $81 million in disclosed funding. Also, startup funding exceeded $50 million for the first time ever in a single quarter.

That is until Q3. It’s hard to explain what happened in Q3. Quite simply, it’s mind-blowing.

Celebrity VCs made their first investments. The Seed round became the Mango Seed. The valuations soared. Finding talent became a challenge. And founders and stakeholders gained airtime on international and national media.

This resulted in a bumper quarter.

Pakistani startups raised a record $172 million in Q3. This is the best quarter since I started keeping track in 2013. There was more money raised in Q3 than in any of the previous seven years combined; 2014-2020.

It’s Bananas. And Mangoes.

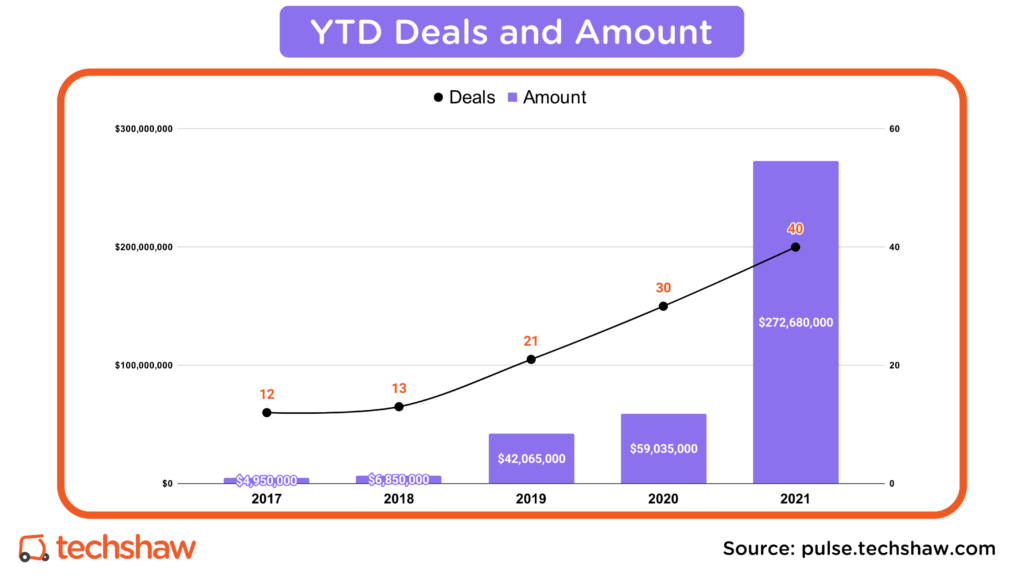

To date, Pakistani startups have raised approximately $273 million in disclosed funding. Again, this is a record in comparison to 2020, when the previous record was set with $59 million.

Let’s do the numbers.

$600,000

Trukkr, the Karachi-based freight marketplace startup, raised $600,000 in Seed funding from Anchorless and Kinnow VC.

$2,000,000

DigiKhata, the Faisalabad-based small business accounting startup, raised $2 million in Seed funding from MSA Capital, Shorooq Partners, SOSV, and +92 Ventures.

$3,500,000

Dastgyr, the Karachi-based B2B e-commerce marketplace startup, raised $3.5 million in Seed funding from SOSV, ADB Ventures, Seedstars, Edgebrook Partners, Zayani Venture Capital, and Tricap investments.

$1,000,000

Marham, the Lahore-based HealthTech marketplace startup, raised $1 million in Seed funding from Indus Valley Capital.

$85,000,000

Airlift, the Lahore-based transportation, and logistics startup raised $85 million in Series B funding from 20 VC, Buckley Ventures, Quiet Capital, and Indus Valley Capital. This latest round of funding brings Airlift’s total funding to $109.2 million, making it the most well-funded startup in Pakistan.

$30,000,000

Bazaar, the Karachi-based B2B e-commerce marketplace startup, raised $30 million in Series A funding from Defy Partners, Wavemaker Partners, Acrew Capital, Saison Capital, Zayn Capital, B&Y Venture Partners, Indus Valley Capital, Global Founders Capital, Next Billion Ventures, and Alter Global. This brings Bazaar’s total funding to $37.8 million, making it the 2nd most well-funded startup in Pakistan.

$2,700,000

Walee, the Islamabad-based AdTech startup in the influencer marketing space, raised $2.7 million in Seed funding from Z2C.

$125,000

Abhi, the Karachi-based FinTech startup, raised $125,000 in Seed funding from Y Combinator and graduated from their Summer 2021 batch.

$12,125,000

TAG, the Islamabad-based FinTech startup, raised $125,000 in Seed funding from Y Combinator and graduated from their Summer 2021 batch. Later, it raised $12 million in Seed funding from Liberty City Ventures, Canaan Partners, Addition, Mantis, Fatima Gobi Ventures, and Banana Capital.

Earlier this year, TAG raised $5.5 million in Seed funding. After the latest round of funding, the total funding of TAG stands at $17.6 million, making it one of Pakistan’s most well-funded FinTech startups.

$3,000,000

Truck It In, the Karachi-based freight marketplace startup, raised an additional $3 million in Pre-Seed funding to close its Pre-Seed round of $1.5 million it raised in Q2. It added Picus Capital and Zayn Capital as two new investors. It has now raised a total of $4.5 million in funding.

$1,600,000

Ailaaj, the Lahore-based HealthTech marketplace startup, raised $1.6 million in Seed funding from JS Group, Fazal Din Group, and Leonine Tech Ventures.

$10,000,000

Bridgelinx, the Lahore-based freight marketplace startup, raised $10 million in Seed funding from 20 VC, Buckley Ventures, Indus Valley Capital, Wavemaker Partners, Quiet Capital, TrueSight Ventures, Soma Capital, Flexport, and UNTITLED.

$2,100,000

Maqsad, the Karachi-based EdTech startup, raised $2.1 million in Pre-Seed funding from Indus Valley Capital, Alter Global, and Fatima Gobi Ventures.

$3,000,000

Oraan, the Karachi-based FinTech startup in the personal credit space, raised $3 million in Seed funding from Zayn Capital, Resolution Ventures, i2i Ventures, Hustle Fund, Haitou Global, and Wavemaker Partners.

$15,000,000

Qisstpay, the Islamabad-based FinTech startup in the buy-now-pay-later space, raised $15 million in Seed* funding from MSA Capital, Global Founders Capital, Fox Ventures, First Check Ventures, and United Bank Limited.

*The round was a mixture of pre-seed, seed, and debt. Because details are not available, I am calling it Seed for simplicity’s sake.

Some of the amounts in the description are rounded for simplicity. You can find the exact amounts here.

Acquisitions

Abwaab, the Jordan-based EdTech startup, acquired Pakistan-based Edmatrix – a social learning platform – for an undisclosed amount.

TruKKer, the U.A.E-based digital freight marketplace, acquired Pakistan-based TruckSher – the local digital freight marketplace – for an undisclosed amount.

This list includes VC or Angel funded active startups that have publicly disclosed their funding using credible media outlets and:

- founded or co-founded by a Pakistani and headquartered in Pakistan and or having majority of operations or employees or founders/co-founders in Pakistan.

- founded by non-Pakistani but based, operated and or for the Pakistani market.

- founded or co-founded by a Pakistani, having a HQ in different country but the leadership and majority of the team in Pakistan.

Mango Seed

Mango Seed is a term used to describe large seed rounds. The debate was between Avocado and Mango. Mango won because it flows, 2 syllables and it tastes better. Sindhri anyone?

Venture capital is evolving rapidly. And Mango Seeds have become a norm in the past 2-3 years.

VCs around the world are raising ever-larger Seed funds. Greylock, for instance, announced a $500 million Seed fund on the heels of Andreessen Horowitz’s $400 million Seed fund announced last month.

That’s $900 million just competing to write the first check. Intensifying the race to get in early results in a Seed round that rivals Series A in size.

But that’s just a couple of Silicon Valley VC firms. Where does Pakistan fit in?

In Pakistan, foreign venture capital firms dominate Seed-stage funding. Although they don’t have a Pakistan-specific fund, all of them have regional Seed or Growth funds. As they examine the region and compare it to the bustling startup ecosystem in India, they hope one-day Pakistani startups will reach the same scale and their investments will result in outsized returns.

And the data shows that they do not mind writing large Seed checks.

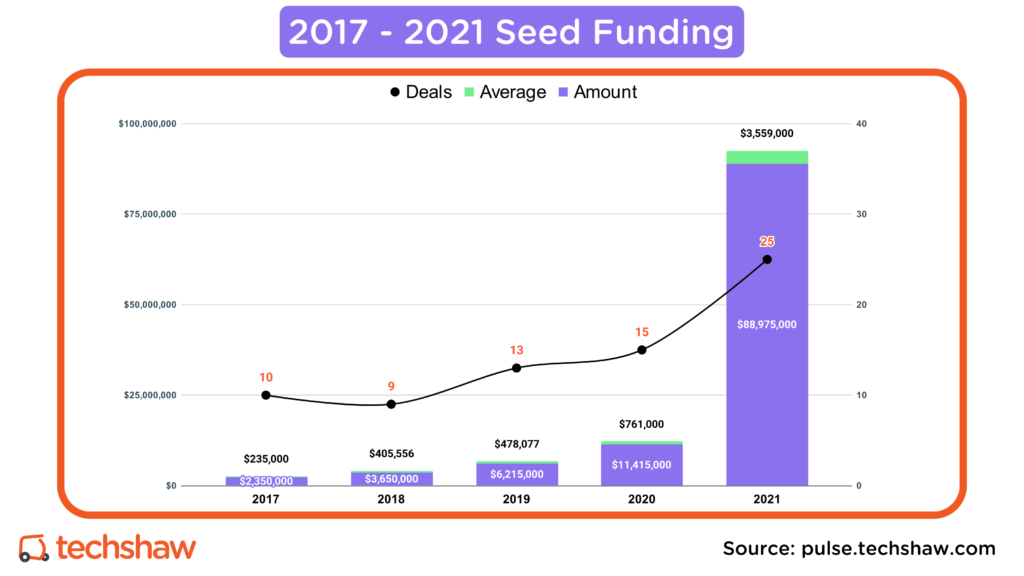

In 2020, the average Seed round was $761,000 (median $250K) whereas in 2021, it increased to $3.6 million (median $2 million). The average Seed round has increased 368% year-to-date compared to 2020.

In just Q3 of this year, BridgeLinx, TAG, and QisstPay announced $10+ million Seed rounds. That used to be a typical Series A in Pakistan and in some cases (Bykea 2020) Series B.

Oh times, they are changin’.

There’s a lot that goes into building a startup ecosystem. The seeds from yesteryears are starting to bear fruit. The grit of founders, relentless enthusiasm of stakeholders, and the ever-increasing risk appetite of investors is in full force.

P.S. Thank you Zubair Naeem Paracha for reviewing the list of startups for this post.