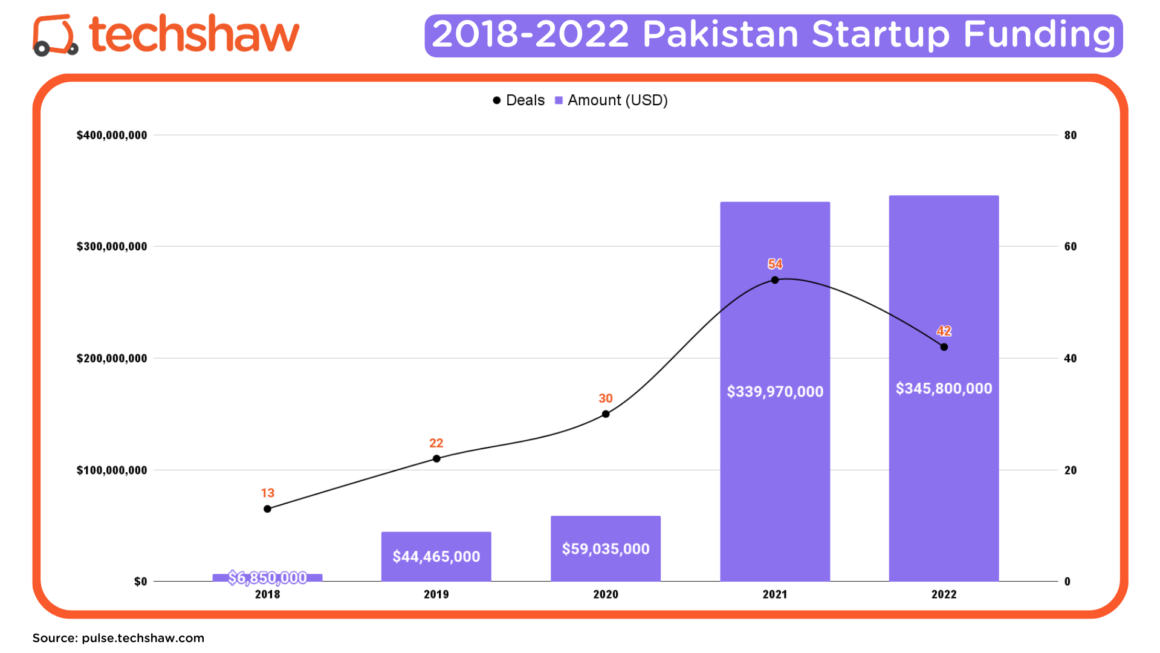

In 2022, Pakistani startups raised $346+ million in disclosed funding across 42 deals.

Compared to 2021, the amount of funding increased by 2% from $340 million, but the number of deals declined by 22% from 54.

The Hangover Year

If 2021 was the banner year for the Pakistani startup ecosystem – funding jumped 5.8x (476%) from the previous year – then 2022 was the hangover year.

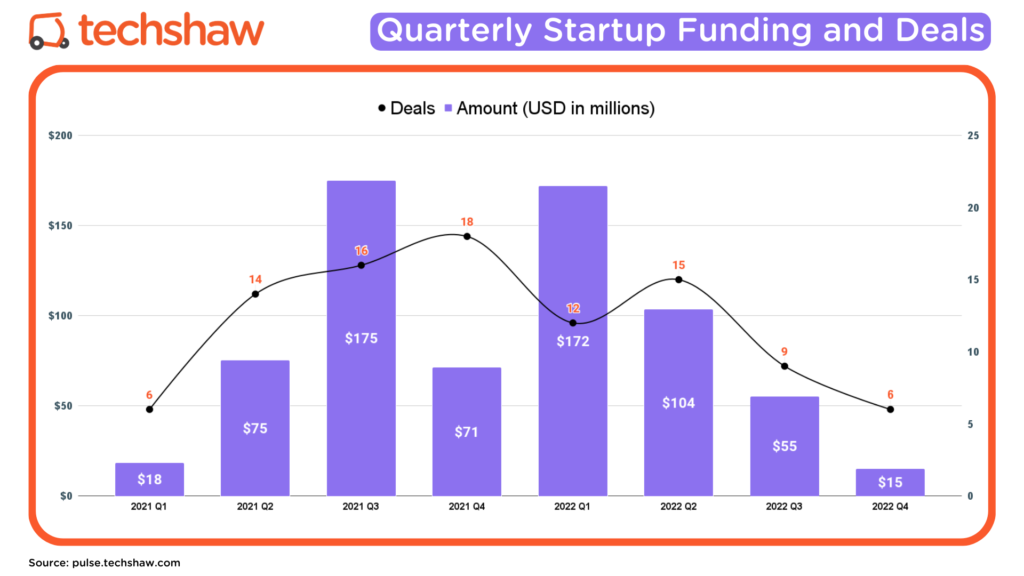

It usually takes 2-3 months for the round to be announced after it is closed. Many deals that closed in Q4 of 2021 were announced in early 2022.

$172 million in startup funding was announced in Q1 of 2022 – half of all funding in 2022.

And then things started to cool down. Quarter-over-quarter (QoQ), Q2 funding decreased by 40%, and Q3 funding dropped by 47%.

For Q4, the amount of funding and deals declined by 79% and 67%, respectively, compared to the Q4 of 2021, and by 73% and 33%, respectively, compared to the Q3 of 2022.

The declining trend is more evident if you look at the month-over-month (MoM) funding and deals.

E-commerce attracted the most funding and deals in 2022, followed by FinTech and Transportation.

Compared to 2021, E-commerce deals declined by 6% and the amount by 2%. FinTech and Transportation witnessed an increase in funding, 22% and 62%, respectively. On the other hand, FinTech deals dropped 13%.

Criteria: Active VC or Angel-funded startups founded by a Pakistani and headquartered in Pakistan with the majority of employees and at least one founder in Pakistan and a product created for the global and Pakistani market. If not headquartered in Pakistan, the majority of employees and at least one founder is in Pakistan. It does not include rounds with funding amounts less than $250,000.

Data sources: internal tracker, i2i deal flow tracker, and Data Darbaar.

*Some numbers are rounded up/down for clarity.