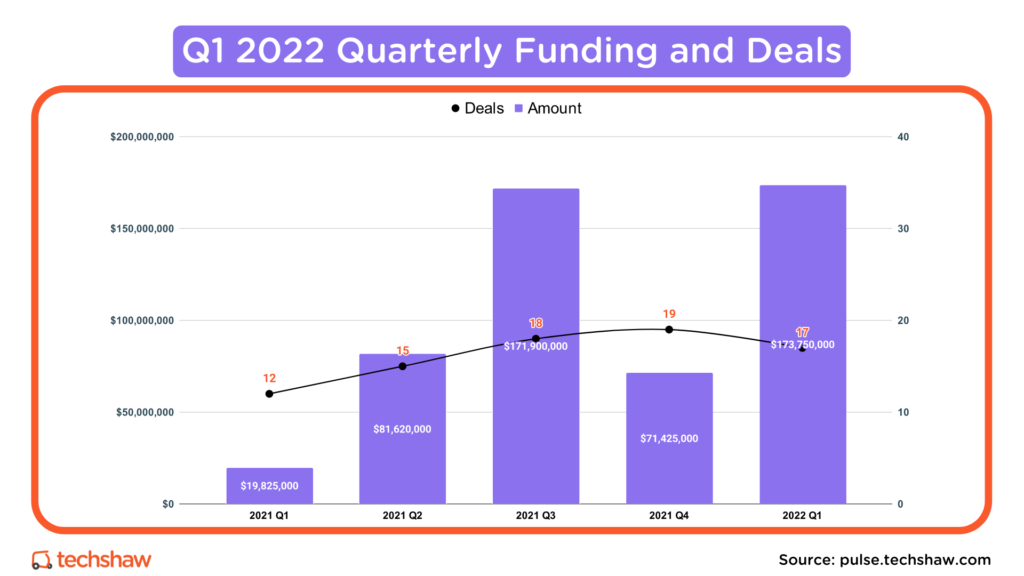

Pakistani startups raised $174 million in disclosed funding across 17 deals in the first quarter of 2022.

Compared to the first quarter of 2021, it’s an increase of 776% from $20 million. And, compared to the fourth quarter of 2021, it is an increase of 140% from $71 million.

During the first three months of the year, Pakistani startups raised half of the total funding raised in 2021.

It was also the best quarter for Pakistani startups EVER. Previously, 18 deals totaling $172 million were recorded in Q3 of 2021.

Highlights

- Startups: 17

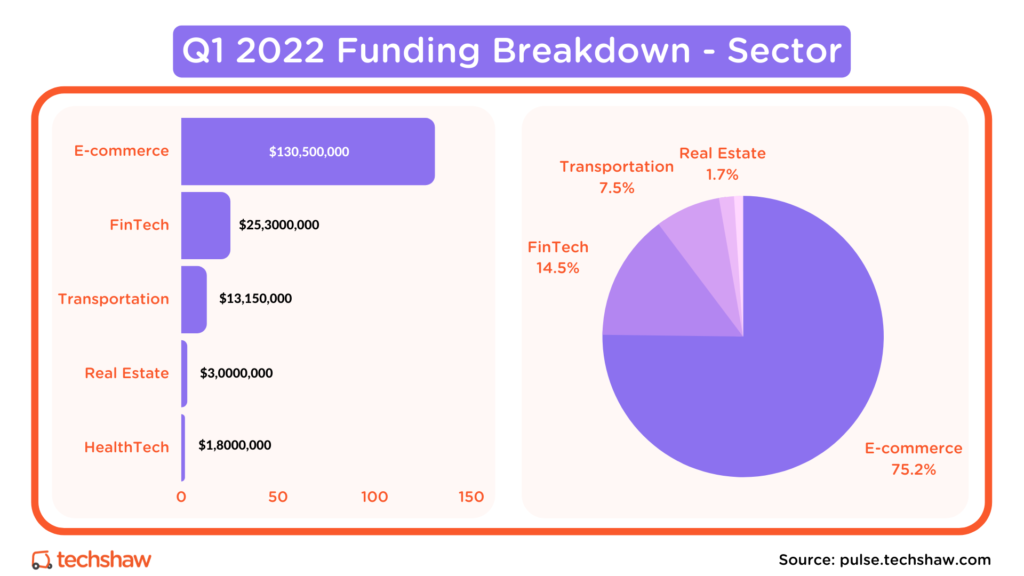

- Sector with the most funding: E-commerce; $131 million.

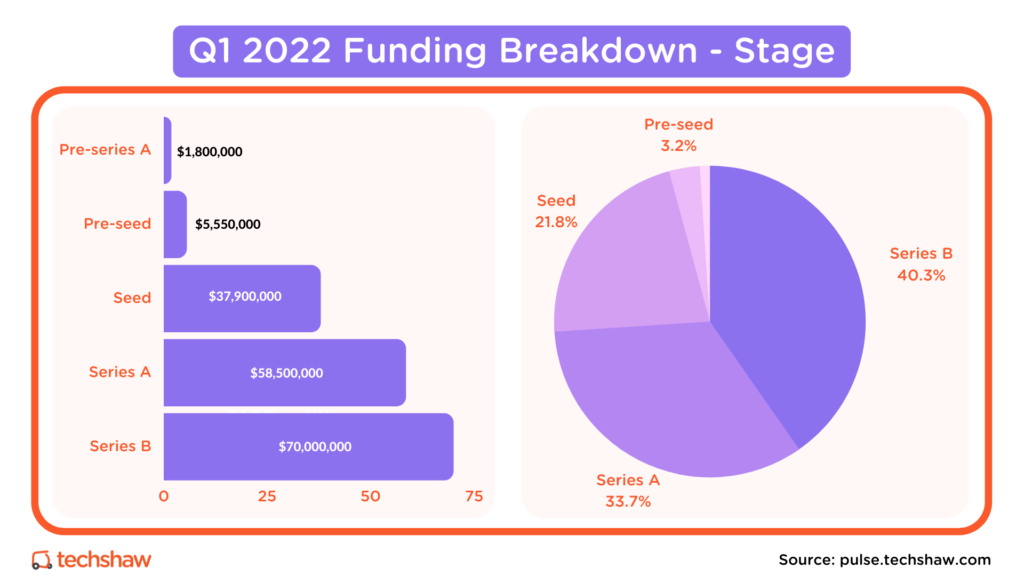

- Startup with the biggest round of funding: Bazaar; $70 million Series B.

- Stage with the most deals: Seed; 8 deals worth $38 million.

- Most active investor: Zayn Capital; 4 deals.

Sector – Deals and Funding

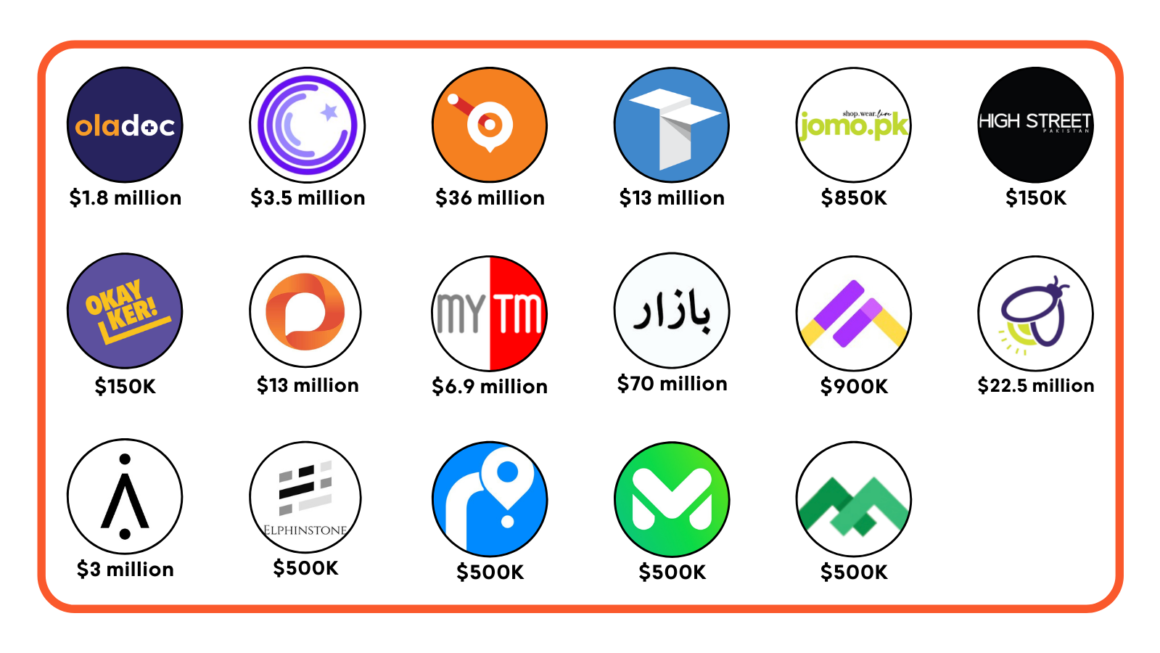

It was an excellent quarter for E-commerce startups with 7 deals totaling $130,500,000.

- Retailo: $36,000,000

- JOMO: $850,000

- High Street: $150,000

- Bazaar: $70,000,000

- Jugnu: $22,500,000

- Markaz: $500,000

- Rider: $500,000

FinTech was a distant second with 6 deals totaling $25,300,000.

- Taro: $3,500,000

- NayaPay: $13,000,000

- MyTM: $6,900,000

- Metric: $900,000

- Mahaana: $500,000

- Elphinstone: $500,000

The Transportation sector had two deals totaling $13,150,000.

- Truck It In: $13,000,000

- OkayKer: $150,000

The Real Estate and Health Tech sectors had one deal each totaling $4,800,000.

- Oladoc: $1,800,000

- COLABS: $3,000,000

Pre-seed

Taro Technologies raised $3.5 million in pre-seed funding from undisclosed investors.

JOMO raised $850,000 in pre-seed funding from Systems Ventures.

Metric raised $900,000 in pre-seed funding from i2i Ventures, Ratio Ventures, Deosai Ventures, Kinnow Capital, Outliers Venture Capital, and Augmentor Capital.

OkayKer and High Street raised $150,000 each from SOSV and graduated from its MOX accelerator program.

Seed

Truck It In raised $13 million in seed funding from Global Founders Capital, Fatima Gobi Ventures, Picus Capital, Millville, Zayn Capital, i2i Ventures, ADB Ventures, Cianna Capital, Reflect Ventures, and K3 Ventures.

NayaPay raised $13 million in seed funding from Zayn Capital, MSA Novo, Graph Ventures, Saison Capital, Maple Leaf Capital, and angel investor Warren Hogarth.

MyTM raised $6.9 million in seed funding from My Petroleum (My Group), 100 Ventures, Loyal VC, United Seven Hills Venture, and PEX International.

COLABS raised $3 million in seed funding from Indus Valley Capital, Zayn Capital, Fatima Gobi Ventures, Shorooq Partners, Kinnow Capital, Muir Capital, Sai Ventures, and multiple angel investors.

Elphinstone, Mahaana, Markaz, and Rider raised $500,000 each from Y Combinator and graduated from its W22 accelerator program.

Pre-series A

Oladoc raised $1.8 million in pre-series A funding from Sarmayacar and Doha Tech Angels.

Series A

Retailo raised $36 million in Series A funding from Graphene Ventures, 500 Global, Agility, Aujan, Tech Invest Com, Mentor’s Fund, Shorooq Partners, Abercross Holdings, Arzan VC, and AgFunder.

Jugnu raised $22.5 million in Series A funding from Sary, Sarmayacar, and Systems Limited.

Series B

Bazaar raised $70 million in Series B funding from Dragoneer Investment Group, Tiger Global Management, Indus Valley Capital, Defy.vc, Acrew Capital, Wavemaker Partners, B&Y Venture Partners, and Zayn Capital.

Active Investors and Top Deals

Zayn Capital was the most active investor in Q1 2022 with four deals. They were followed by Shorooq Partners, Sarmayacar, Kinnow Capital, Indus Valley Capital, i2i Ventures, Fatima Gobi Ventures, and System Ventures, which each invested in two companies.

COLABS’ $3 million seed round appears to have attracted the most attention among all well-known VCs.

Bazaar’s $70 million Series B was the quarter’s top deal.

The deal marks the first investment for a startup in Pakistan, led by both Tiger Global and Dragoneer Investment Group. It is also Dragoneer’s first investment in Pakistan.

Acquisition

GoZayaan acquired FindMyAdventure, a Karachi-based adventure travel marketplace.

GoZayaan did not disclose how much it paid for FindMyAdventure. However, Bloomberg and Deal Street Asia report the deal size as $3.5 million.

Endnote

If you think I missed a startup, please DM me on Twitter with the link to the startup funding announcement.

If you are interested in accessing the entire database that includes all startup funding transactions since 2014, you can purchase it here.

This list includes VC or Angel-funded active startups founded or co-founded by a Pakistani and headquartered in Pakistan and or having the majority of operations or employees or founders/co-founders in Pakistan.

Data sources: internal tracker, i2i deal flow tracker, and Data Darbaar.