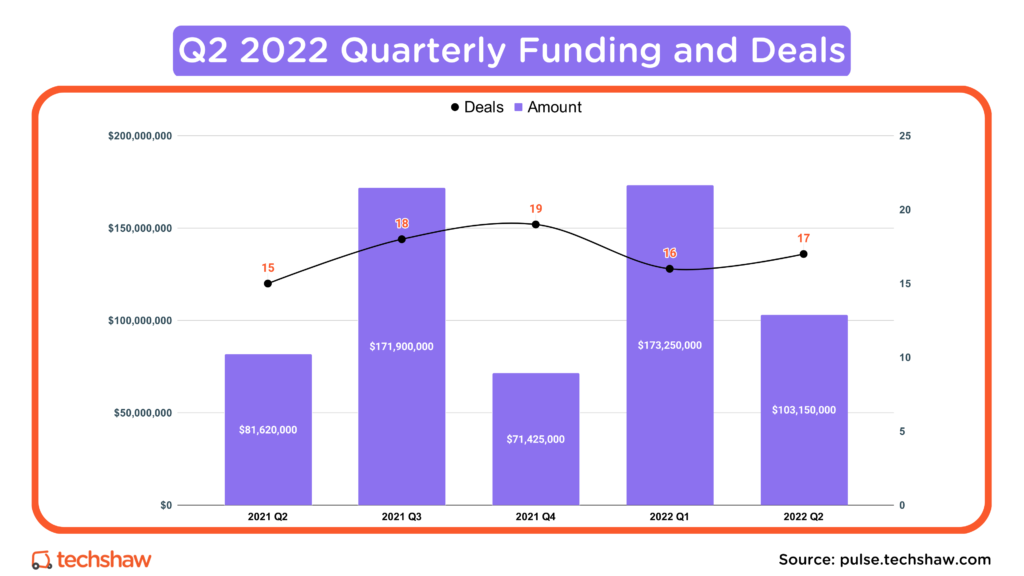

Pakistani startups raised $103 million across 17 deals in the second quarter of 2022.

This is a 26% increase from $82 million in the second quarter of 2021. But compared to the first quarter of 2022, funding decreased 41% from $174 million.

Overall, Q2 was a mixed bag.

Startups raised money, announced layoffs, shut down locations, acquired other startups, and exited.

Everything except the layoffs points to a healthy ecosystem.

Highlights

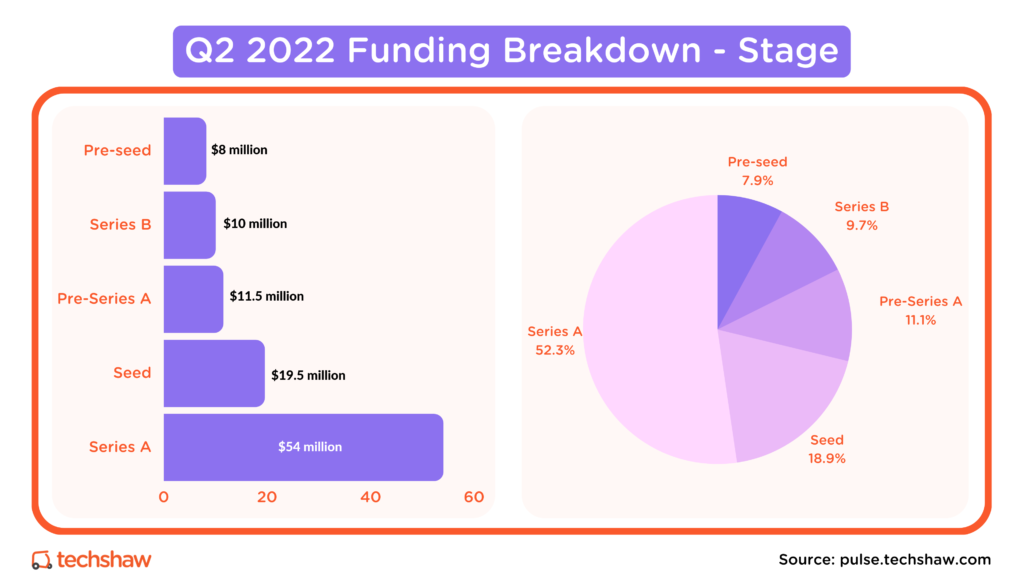

- Startups: 17

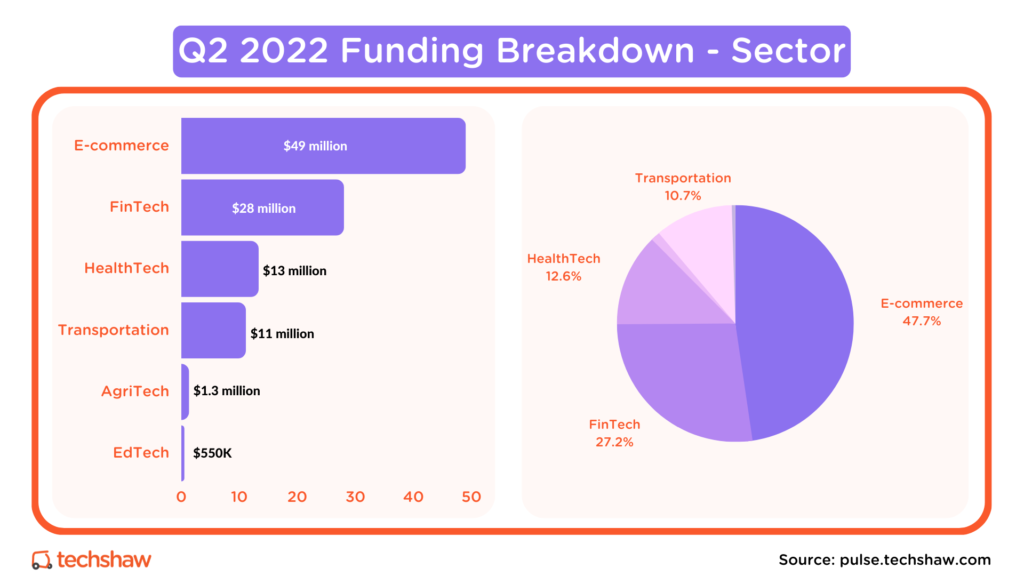

- Sector with the most funding: E-commerce; $49 million.

- Startup with the biggest round of funding: Dastgyr; $37 million Series A.

- Stage with the most deals: Seed; 10 deals worth $19.5 million.

- Most active investor: Tie between i2i Ventures and Reflect Ventures; 3 deals each.

Slowdown, maybe

Pakistani startups had an impressive start to the year, raising $174 million in the first quarter.

In fact, Pakistani startups raised half of the total funding raised in 2021 in the first three months of the year.

Not only that, but it was the best quarter for Pakistani startups EVER. Previously, $172 million was recorded in Q3 of 2021.

But then the country faced some political headwinds in April.

Without going into details, let’s say that investors don’t like uncertainty because it means they need to adjust their risk premium.

And when you factor in global macroeconomic factors, less money is available to chase growth-stage startups, resulting in a regression to the mean for those once valued at triple-digit revenue multiples.

Eventually, dust settles, and bubble-like environments disappear.

Yes, it’s really strange that investors are pricing in a recession even though there isn’t one yet. And startup valuations worldwide have suffered as a result in recent months.

In a world where venture capital is more global, a downturn in the world’s largest economy can have ripple effects.

However, if you look at the data, there’s a slowdown, but not all doom and gloom – at least not yet.

The next two quarters will be interesting as more startups close funding rounds and raise funds outside a bubble environment.

Let’s do the numbers.

E-commerce

With seven transactions totaling $49 million, it was another excellent quarter for e-commerce startups.

Pre-seed

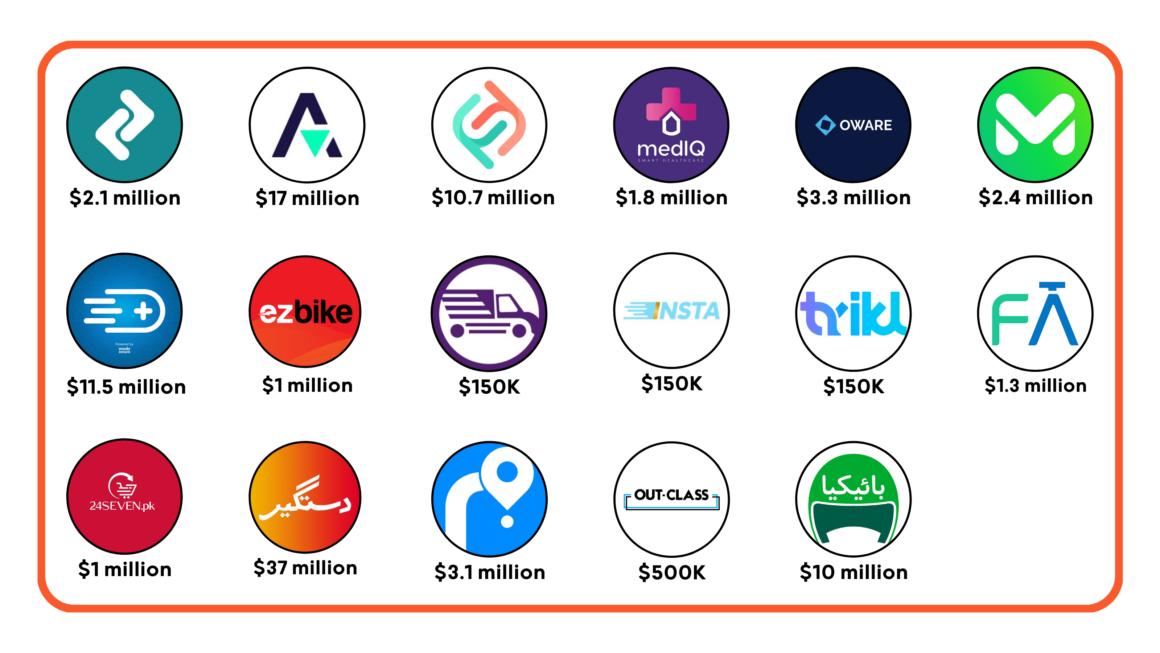

Karachi-based Oware raised $3.3 million from Flexport Fund, Ratio Ventures, Seedstars International Ventures, Sketchnote Partners, Swiss Founders Fund, Reflect Ventures, +92 Ventures, and Walled City Co.

Karachi-based Zaraye raised $2.1 million from Tiger Global, Zayn Capital, +92 Ventures, and multiple angel investors.

Seed

Lahore-based startup 24Seven.pk raised $1 million from Betatron Venture Group.

Islamabad-based Instaworld raised $150k from SOSV after graduating from one of its accelerator programs.

Islamabad-based Markaz raised $2.4 million from Indus Valley Capital.

Karachi-based Rider raised an additional $3.1 million from Y Combinator, i2i Ventures, Soma Capital, Flexport Fund, Rebel Fund, Global Founders Capital, Fatima Gobi Ventures, and TPL E-Ventures.

Series A

Karachi-based B2B Dastgyr raised $37 million from VEON Ventures, Zinal Growth, DEG, Khwarizmi Ventures, OTF Jasoor Ventures, Cedar Mundi, Reflect Ventures, Century Oak Capital, Hi2 Global, GoingVC, Astir Ventures, K3 Diversity Ventures, Chandaria Capital, SOSV, Edgebrook Partners, and EquiTie.

FinTech

FinTech was a not-so-distant second with three deals totaling $28 million.

Seed

Islamabad-based SadaPay raised $10.7 million in a seed extension from Recharge Capital, Kingsway Capital, and Raptor Group.

Karachi-based Trikl raised $150k from SOSV after graduating from one of its accelerator programs.

Series A

Karachi-based Abhi raised $17 million from Speedinvest, Global Ventures, VentureSouq, VEF, Sturgeon Capital, Rallycap, FJ Labs, Fatima Gobi Ventures, Sarmayacar, and i2i Ventures.

HealthTech

The HealthTech sector had two deals totaling $13.3 million.

Pre-seed

Islamabad-based MedIQ raised $1.8 million from Amaana Capital, Cordoba Ventures, Seraph Group, TAJDEED, APPNA, and House of Habib.

Pre-Series A

Karachi-based MEDZnMORE raised $11.5 million from Integra Partners, Nunc Gestion, Sturgeon Capital, Alta Semper, Al Touq Group, ACE & Company, Key Family Partners, Reflect Ventures, and Atlas Asset Management.

Transportation

The transportation sector had three deals totaling $11.1 million.

Pre-seed

Islamabad-based ezBike raised $1 million from i2i Ventures, Walled City, and GroundUp.

Seed

Islamabad-based MoveIt raised $150k from SOSV after graduating from one of its accelerator programs.

Series B

Karachi-based Bykea raised $10 million in Series B extension from Prosus Ventures, Middle East Venture Partners, Sarmayacar, Tharros, and Ithaca Capital.

AgriTech and EdTech

The AgriTech and EdTech sectors had one seed deal each totaling $1.8 million.

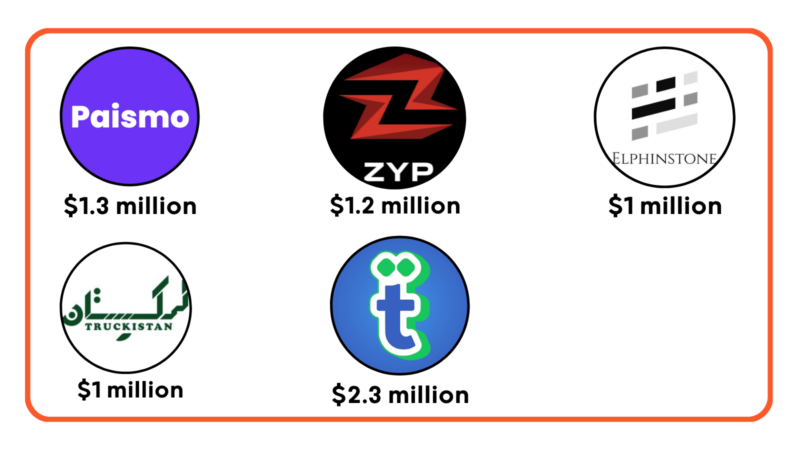

Karachi-based Farmdar raised $1.3 million from Indus Valley Capital, Deosai Ventures, Tricap Investments, United Distributors Pakistan Limited, The Community Fund VC, LMKR, and K2 Global Ventures.

Lahore-based Out-Class raised $500,000 from the House of Habib.

Active Investors and Top Deals

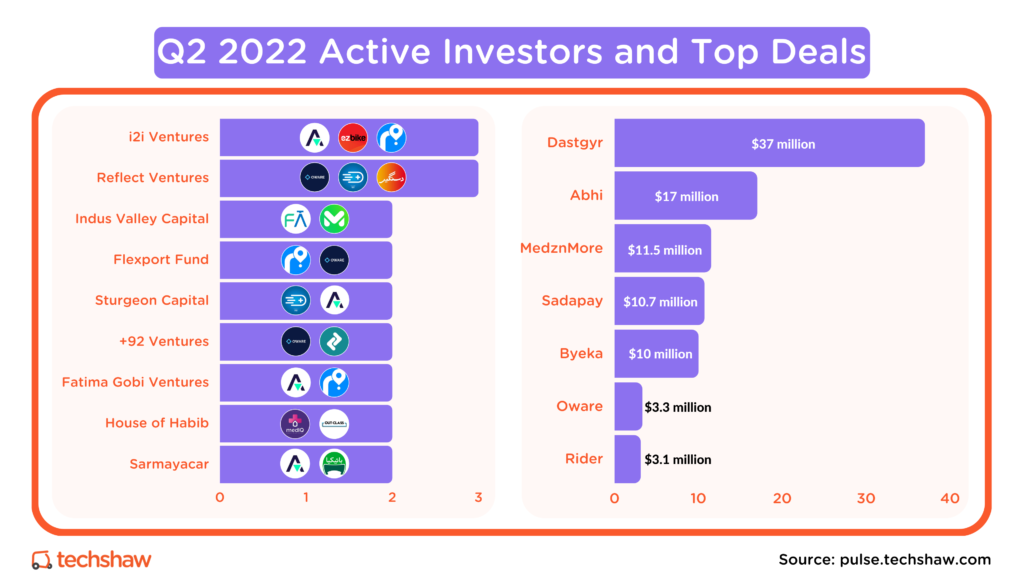

i2i Ventures and Reflect Ventures are tied for the most active investors with three deals each.

They were followed by House of Habib, Indus Valley Capital, Flexport Fund, Sturgeon Capital, +92 Ventures, Fatima Gobi Ventures, and Sarmayacar, which each invested in two startups.

Reflect Ventures was involved in three deals totaling $52 million. In other words, Reflect Ventures was part of half of all the amount raised by Pakistani startups in Q2.

Dastgyr’s $37 million Series A was the quarter’s top deal. It’s also the biggest Series A raised by a startup in Pakistan.

Shutdowns and Layoffs

Pakistani startups announced layoffs for the first time during Q2.

Pakistan’s most well-funded startup, Airlift, announced that it would close operations in some cities and withdraw from South Africa entirely, reducing its overall headcount by 31% (about 400 employees).

Within a few days of Airlift’s announcement, Truck It In, a Karachi-based freight marketplace startup, announced it would lay off 30% of its workforce.

This was followed by social media posts from Retailo and Dawaai employees claiming to have been laid off due to the economic downturn. No official announcement yet.

Growth stage startups were not the only ones to announce layoffs.

SWVL, which recently went public and has a significant presence in Pakistan, announced layoffs and service suspensions in Karachi, Lahore, Islamabad, and Faisalabad.

Lastly, Careem suspended its food service in Pakistan and laid off one employee.

One Acquisition, One Exit

Retailo acquired DXBUY, a UAE-based B2B e-commerce marketplace, for an undisclosed amount.

DXBUY was founded in 2019 by brothers Adnan and Rizwan Zubairi and had raised $800,000 in disclosed funding.

ZoodPay, a provider of buy now, pay later (BNPL) services in the Middle East and Central Asia, acquired Tez Financial Services for an undisclosed amount.

Tez had previously raised $1.1 million in funding from Planet N, Flourish (Omidyar Network), and Accion Venture Lab.

Endnote

If you think I missed a startup, please DM me on Twitter with the link to the startup funding announcement.

If you are interested in accessing the entire database that includes all startup funding transactions since 2014, you can purchase it here.

This list includes VC or Angel-funded active startups founded or co-founded by a Pakistani and headquartered in Pakistan and or having the majority of operations or employees or founders/co-founders in Pakistan. Startups that have not disclosed their funding amount publicly are not included in this list.

Data sources: internal tracker, i2i deal flow tracker, and Data Darbaar.

Be the first to know when a startup receives funding. Sign up below.